STOP THE AGEIST STEREOTYPE

As a society, we are continually evolving in our acceptance of past stigmas. But while we are evolving, why is ageism still so prominent and accepted. And what can we do to shine a light on this issue?

As a society, we are continually evolving in our acceptance of past stigmas. But while we are evolving, why is ageism still so prominent and accepted. And what can we do to shine a light on this issue?

Overrepresentation of an underrepresented cohort

A recent research study with Brainsights reveals that many of us don’t know how to properly address the Canadian 55+ demographic. In fact, since only 6% of the advertising workforce is 50+, this cohort is highly misinterpreted causing many people to completely miss the mark when advertising or communicating with them. But why is this important? Firstly, this demographic is continuing to grow and is now the largest demographic in Canada (with 11 million Canadians falling into this segment), secondly a Yale University research found that older people with positive perceptions of aging lived seven-and-a-half years longer than those with negative perceptions. Knowing how to properly engage with Canadians 55+ not only make us feel better about aging ourselves, it can also help us live longer.

We’ve heard you loud and clear

Brainsights, in partnership with HomeEquity Bank, analyzed the brain activity of more than 300 Canadians, with an equal split between Canadians under 55 and over 55. These individuals were then showed 117 pieces of video content, including ads targeted at Canadians 55+, news clips, movie trailers etc. Their brain waves were recorded, measuring levels of attention, emotional resonance, connection and encoding.

This research reveals four key actions we can all take to bust the age bias.

1) Old Age Stereotypes alienate Canadians 55+

The media portrays Canadians 55+ as frail and helpless. The reality is, Canadians are living longer and healthier lives than ever before, and Canadians over the age of 55 are just as lively and adventurous as someone in their 30s. We all need to start viewing this cohort as vibrant, educated and enthusiastic.

2) Don’t underestimate the power of nostalgia

Many of the communications targeted at the Canadian 55+ demographic tend to focus on what lies ahead. But research shows that nostalgia can be very powerful especially for Canadians 55+. In fact, ads tagged with nostalgia as a theme worked well overall for the 55+ segment, driving 11% greater attention, 9% greater emotional connection, and was 13% more memorable than the average. Canadians 55+ may be experiencing anxiety or stress of not knowing what lies ahead, but nostalgia can give a sense of comfort by providing certainty and familiarity.

3) Positive recollection

Canadians 55+ have an inherent desire to leave the world in a better place, and they do so through the transfer of knowledge to their children. Leaving a legacy for future generations leads to a 27% increase in attention, 42% increase in connection and 31% increase in encoding. Canadians 55+ like to feel like they made a difference in the world and specifically in the knowledge they leave behind to their children. It’s this type of content that they connect best with.

4) Digestible chunks can go a long way

Science proves that as we age, we require more cognitive resources to process information. So, while the 55+ group likes information, it needs to be presented in smaller chunks. This may require multiple conversations or giving older Canadians time to digest what they heard. Sometimes written in an email can be better than spoken on the phone, since it provides time to review and digest the message.

In summary

By measuring the brain waves of both Canadians over and under 55, we now understand how we can all improve the way we communicate. Through this research study, HomeEquity Bank has also raised awareness to emphasize the prevalence of ageism and that Canadians are not just looking to retire in silence, but rather, retirement is a time to live a vibrant and active lifestyle in the home they love!

Why this matters to us

HomeEquity Bank is a proud partner of Dominion Lending Centres. As a 100% Canadian company working for aging Canadians, HomeEquity Bank has been in business for over 30 years as advocates for the Canadian 55+ demographic. They have been working to not only help empower the 55+ demographic, but they are always at the forefront of pushing back against stereotypes of aging. They are passionate about our aging demographic and what is needed in order to live a well-deserved retirement. It is through this, that they commissioned this research with Brainsights to further understand our aging demographic.

HomeEquity Bank is a proud partner of CARP, a non-profit organization that advocates on behalf of Canadians as we age. Under this partnership, HomeEquity Bank is now officially endorsed and recommended by CARP as a trusted financial solution during your retirement years. As a special offer, CARP members can receive a cash rebate of up to $250 on a home appraisal. Contact your DLC mortgage broker to find out more about this special offer.

Contact your DLC Mortgage Broker to find out if the CHIP Reverse Mortgage solution is the right one for you.

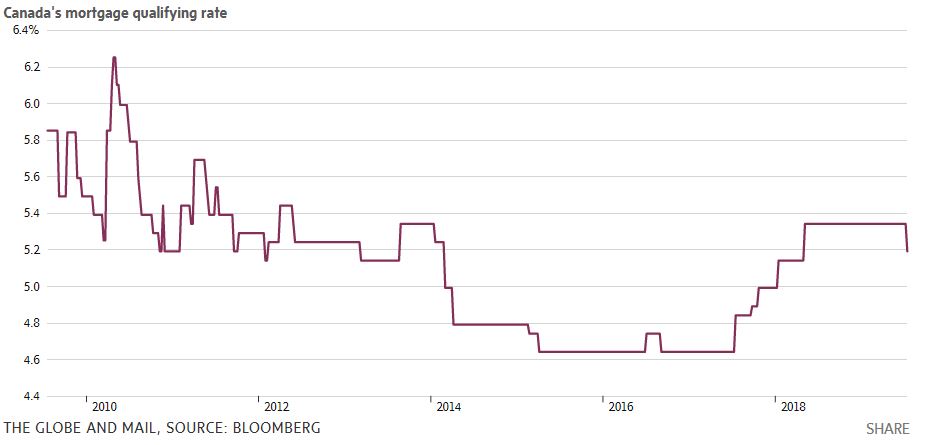

If that sounds convoluted, RateSpy’s Rob McLister tells us this, in laymen’s terms: “What happened here was that the total Canadian assets of the three banks posting 5.34% fell much more than the total Canadian assets of the three banks posting 5.19%. The 5.19%-ers won out this week,” McLister said.

If that sounds convoluted, RateSpy’s Rob McLister tells us this, in laymen’s terms: “What happened here was that the total Canadian assets of the three banks posting 5.34% fell much more than the total Canadian assets of the three banks posting 5.19%. The 5.19%-ers won out this week,” McLister said.

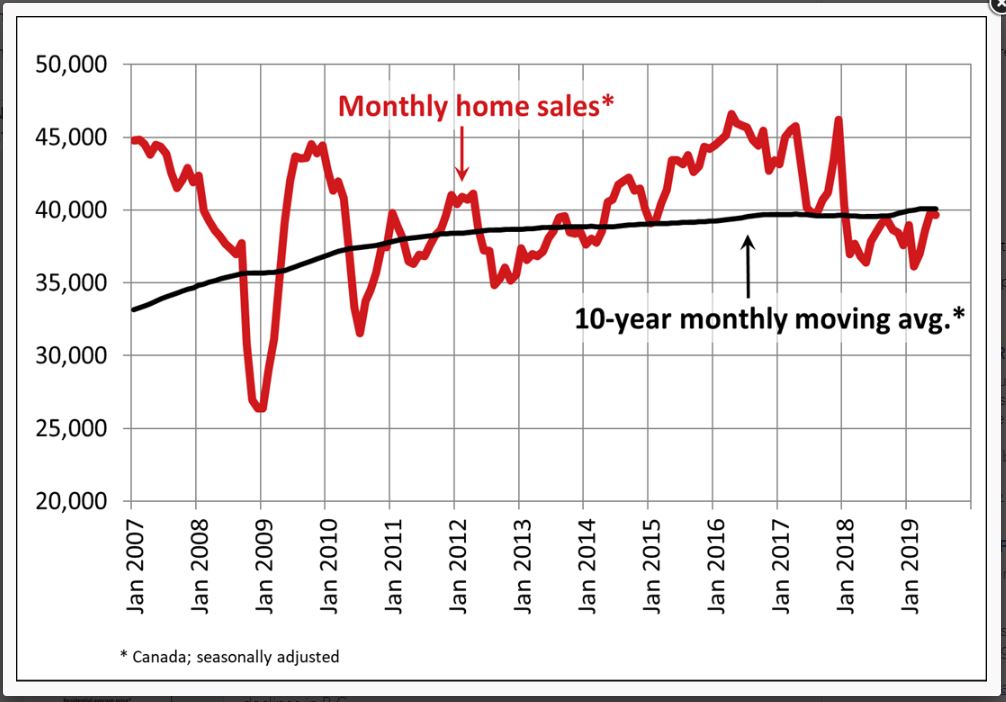

“A stable market isn’t a bad thing,” noted senior economist Robert Hogue. “This is sure to disappoint those hoping for a snapback in activity, especially out west. But it should be viewed as part of the solution to address issues of affordability and household debt in this country…It means that signs indicating we’ve passed the cyclical bottom have been sustained last month.”

“A stable market isn’t a bad thing,” noted senior economist Robert Hogue. “This is sure to disappoint those hoping for a snapback in activity, especially out west. But it should be viewed as part of the solution to address issues of affordability and household debt in this country…It means that signs indicating we’ve passed the cyclical bottom have been sustained last month.”

Use of Alternative Lenders Increasing

Use of Alternative Lenders Increasing Other Key Stats

Other Key Stats

–

–