Bank of Canada Holds Overnight Rate at 0.25% and Recalibrates Bond-Buying Program

Bank of Canada Recalibrates Quantitative Easing

As expected, the Bank held its target overnight rate at the effective lower bound of 25 basis points with the clear notion that negative policy rates are not in the cards. Instead, the central bank will continue to rely on large-scale asset purchases–quantitative easing (QE). The central bank is recalibrating its QE program as promised in recent weeks. In mid-October, it announced that it would end its Repo, Bankers Acceptance and Canada Mortgage Bond purchases this month, as they are no longer needed to assure liquidity in those markets. The volumes of purchases have declined sharply since April. This move will have minimal impact on market interest rates.

The Governing Council announced today it would also gradually reduce purchases of federal government bonds from at least $5 billion to at least $4 billion per week. “The Governing Council judges that, with these combined adjustments, the QE program is providing at least as much monetary stimulus as before.”

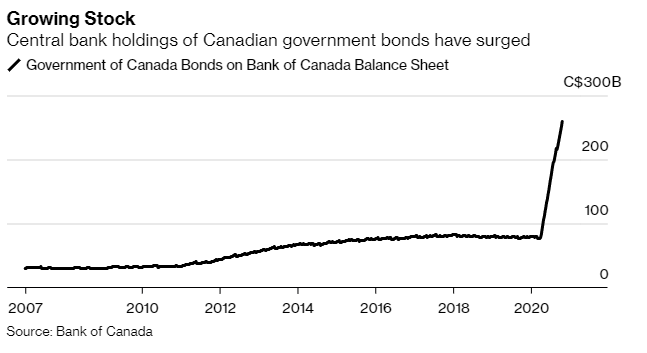

The PC opposition party has been warning Governor Macklem of the risks of financing Trudeau’s government spending. But the Bank has little alternative but to step-up its buying of newly issued benchmark bonds–those currently being sold by the government, as opposed to older debt that is becoming increasingly illiquid. As reported in Bloomberg News, “It means the bank’s quantitative easing program will increasingly mirror government debt sales at a time when opposition lawmakers are warning it against directly financing Prime Minister Justin Trudeau’s fiscal agenda.” (See chart below). The Bank already owns more than a third of all outstanding Government of Canada debt, proportionately more than most central banks because Canada ran budget surpluses, which paid down debt for so long.

Virtually every major central bank in the world is conducting an emergency QE program in response to the COVID-19 crisis. The Bank of Canada says its QE program reinforces its commitment to hold interest rates at historic lows over the next few years until the annual inflation rate is sustainably at its target 2% level. Today’s October Monetary Policy Report indicates they will likely keep the overnight rate at 0.25% until 2023.

The central bank has no intention of paring back stimulus, with risks to the economy growing amid the second wave of COVID-19 cases. “As the economy recuperates, it will continue to require extraordinary monetary policy support,” the bank said. “We are committed to providing the monetary policy stimulus needed to support the recovery and achieve the inflation objective.”

October Monetary Policy Report

- Following the sharp bounce back in growth that occurred when containment measures were lifted, and the economy reopened, the Canadian economy transitioned to a slower, more protracted recuperation phase of its recovery. The recovery phases are proceeding largely as described in the July Report, though the initial rebound was stronger than expected. Furthermore, the near-term slowing in the recuperation phase is likely to be more pronounced due to the recent increase of COVID-19 infections.

- There is ongoing and significant slack in the Canadian economy. The gap between the actual output and the economy’s potential output is not expected to close until 2023. The economy is progressing unevenly, with some sectors and workers disproportionately affected by the virus–particularly those in accommodation, food, arts, entertainment and recreation, as well as global transportation. Many of those hardest-hit are low-income workers.

- Oil prices remain below pre-pandemic levels and are assumed to remain around current levels, hitting Alberta hard.

- Ongoing slack in the economy is expected to continue to hold inflation down into 2023.

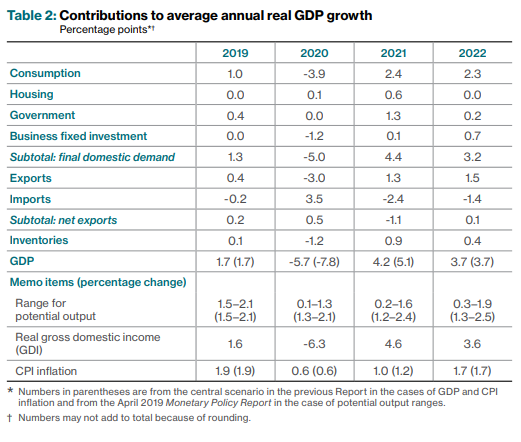

The Bank of Canada’s forecast for Canadian growth is shown in the table below. The economic recovery is projected to be prolonged, underpinned by policy support but largely influenced by the evolution of the virus, ongoing uncertainty and structural changes to the economy. These changes could result in longer-term shifts of workers and capital across different regions and sectors of the economy. This adjustment process weighs on the Bank’s estimates of potential growth.

After declining by about 5 1/2 percent in 2020, the economy is expected to expand by almost 4 percent on average in 2021 and 2022. Two factors will likely lead to quarterly patterns of growth that are unusually choppy: localized outbreaks and containment measures and varied recovery rates across industries.

Inflation is expected to remain below the lower end of the Bank’s inflation-control target range of 1 to 3 percent until early 2021, largely due to the effects of low energy prices. Subsequently, inflation is anticipated to be within the target range, but economic slack will continue to put downward pressure on inflation throughout the projection period.

The Reopening Phase Was Strong But Uneven

Growth is estimated to have rebounded strongly in the third quarter, reversing about two-thirds of the decline observed in the first half of the year. A sizable bounce back in activity resulted from a rebound in foreign demand, the release of pent-up demand for housing and some durable goods, and robust policy support.

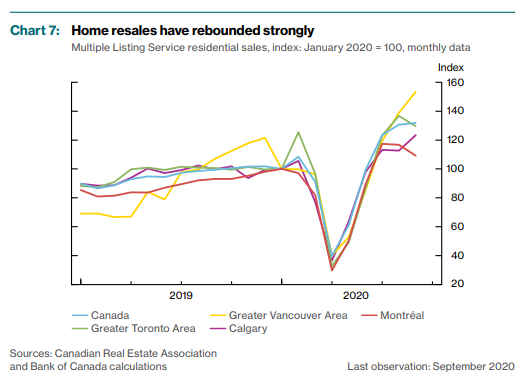

Housing activity recovered sharply in the third quarter, supported by historically low financing costs, resilient incomes for higher-earning households, and extra sales and construction that made up for delayed spring activity (Chart 7). By September, cumulative resales are estimated to have compensated for the missed activity during the normally busy spring market. Housing activity may also be benefiting from changes in preferences. In particular, more than one-quarter of respondents to the Canadian Survey of Consumer Expectations in the third quarter of 2020 reported they would like to move to a larger or single-family home because of the pandemic. The strength of the housing market recovery, combined with a tight resale market, has led to the rapid growth of house prices in some markets. In contrast to the appreciation of house values observed in Toronto and Vancouver in 2016, price growth has been strongest in markets with moderate loan-to-income ratios, such as Ottawa, Montréal and Halifax.

Bottom Line

Interest rates will remain low for the foreseeable future. The pandemic will largely determine the growth of the economy and the government’s response. Experts suggest that this second wave will last for much of the winter and that a widely dispersed vaccine will not be available until at least well into 2021. As tough as that is to take, Canada is still doing a better job of containing the virus than the US, UK and the Euro area. Output is likely to remain below pre-pandemic levels everywhere through the end of 2022, the Bank of Canada’s forecast horizon.

Recapping the company’s journey in a call with investors, Mauris touched on the initial reason for selling 60% of the company to Founders Advantage, saying at that point they were looking to de-risk somewhat, feeling it was the “prudent and responsible” thing to do.

Recapping the company’s journey in a call with investors, Mauris touched on the initial reason for selling 60% of the company to Founders Advantage, saying at that point they were looking to de-risk somewhat, feeling it was the “prudent and responsible” thing to do. One of the key benefits of an interest-only mortgage is its ability to lower your monthly payments (since you’re only paying the interest portion) and makes it easier to qualify, even though the mortgage is restricted to those putting down at least 20%.

One of the key benefits of an interest-only mortgage is its ability to lower your monthly payments (since you’re only paying the interest portion) and makes it easier to qualify, even though the mortgage is restricted to those putting down at least 20%. Cathcart noted that records were in the process of being broken at the start of the year, pre-COVID, due to record-tight overall market conditions.

Cathcart noted that records were in the process of being broken at the start of the year, pre-COVID, due to record-tight overall market conditions. “The question now becomes whether this momentum is sustainable. In our view, home sales are set to cool from their unsustainable third-quarter pace over the next few quarters.”

“The question now becomes whether this momentum is sustainable. In our view, home sales are set to cool from their unsustainable third-quarter pace over the next few quarters.”