A soft landing for Canada is becoming a “distant prospect”

The likelihood of the Bank of Canada’s desired “Goldilocks” outcome of a soft landing for Canada’s economy is growing dimmer, according to a new report from RBC.

The report is based on recent research from BIS, which suggest “front-loaded” tightening cycles, such as the one being undertaken by the BoC, “tend to be followed more frequently by soft landings.”

But that may not hold true this time, RBC argues.

“With policymakers pledging to do what it takes to rein in inflation, we think a soft landing is becoming a distant prospect,” RBC’s economists wrote. “Central banks are aware of the challenge, but only the BoE has been bold enough to forecast a recession.”

RBC currently expects Canada, the U.S. and the UK to see economic contractions beginning later this year or early next year.

“These declines, while unpleasant, are arguably needed to return supply and demand to better balance and ease inflationary pressure,” they added.

The BIS bulletin, entitled “Hard or soft landing,” explores the difficult job central banks have when it comes to controlling inflation while not sacrificing economic activity, at least no more than necessary.

“The policy response to the current rise in inflation involves difficult trade-offs, and the path to a soft landing is narrow,” the report reads. “Tightening too much or too quickly could result in financial stress and a hard landing, inflicting unnecessary damage to the economy. But, tightening too slowly could let inflationary pressures become ingrained, requiring more forceful and costly action down the road.”

RBC adds that the “potential consequences of not acting quickly enough to contain price growth—and possibly, losing all influence over longer-run consumer and business inflation expectations—outweigh the risks of hiking interest rates too much.”

The bank currently expects the BoC to bring the overnight rate to 4% by the end of the year, up from its current level of 3.25%.

“Interest rate cuts could come as soon as the second half of next year if a recession follows as we expect,” the RBC economists noted. “But by the same token, risk remains that interest rates could rise further if inflation pressures don’t show clear signs of deceleration in coming months.”

The coming downturn is expected to be moderate

RBC continues to expect the coming downturn to remain moderate “by historical standards,” according to its current forecast.

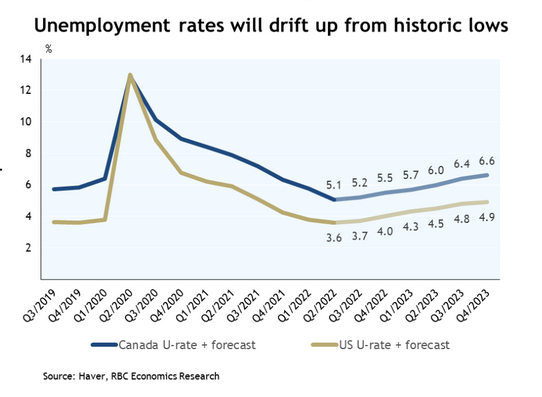

The bank expects the unemployment rate to rise 1.7 percentage points from trough to peak over the next year and a half, which would be “relatively mild” compared to previous downturns, it notes.