Canadian Housing Market Rebounds in September

Canada’s housing market continues to rebound this fall from last winter’s chill.

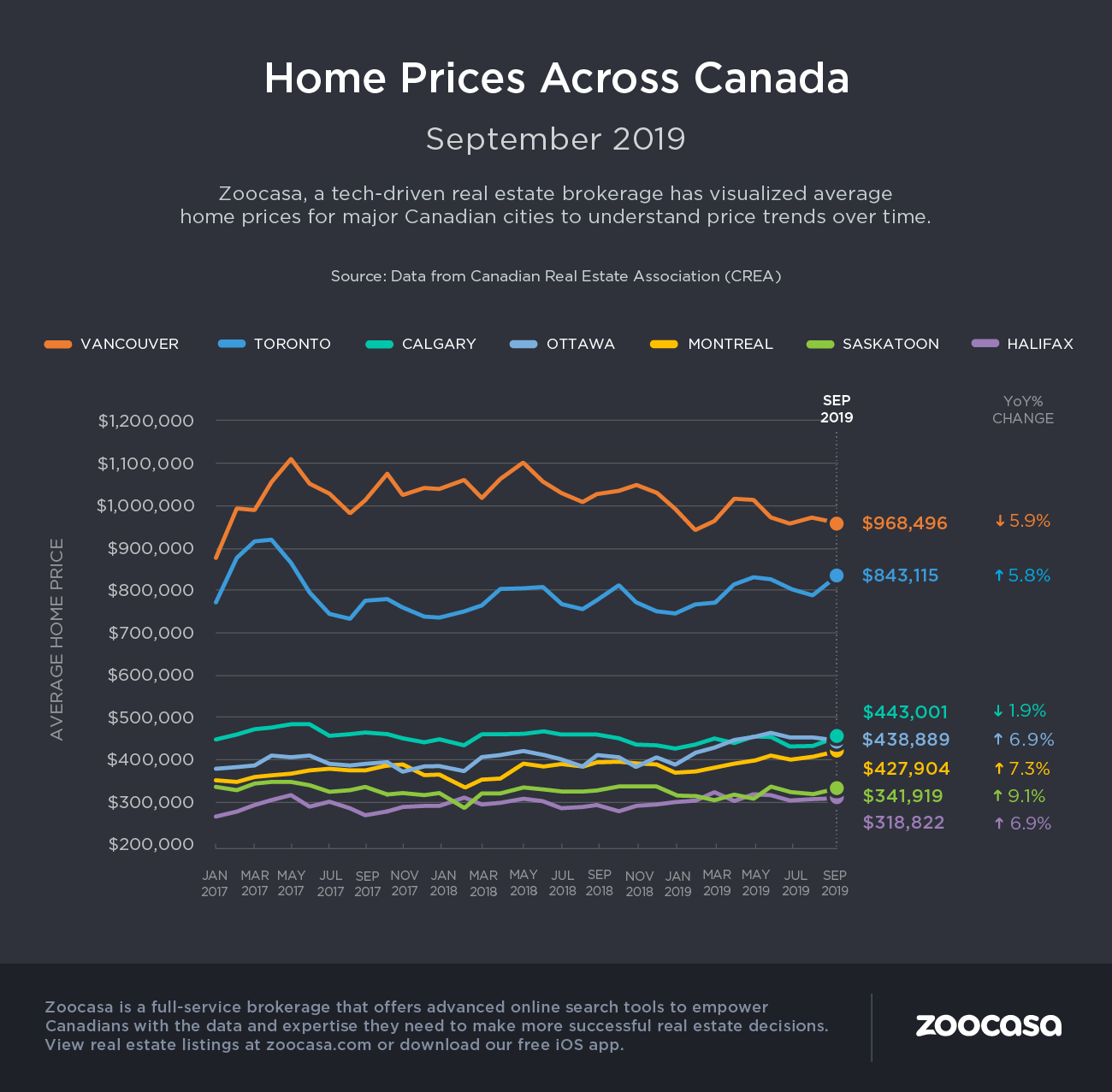

The Canadian Real Estate Association (CREA) reported that benchmark prices rose 0.5% in September from August, and 1.3% year-over-year. The aggregate benchmark price for the 19 cities CREA tracks is now $629,200. The benchmark is the best metric we have for measuring “typical” house prices because it eliminates outliers at the top and bottom of the market. In comparison, the average home price rose 5.3% year-over-year to $515,500.

“In recent months, home prices have generally been stabilizing in the Lower Mainland and the Prairies, where previously they were falling. Meanwhile, price growth has begun to rebound among markets in the Greater Golden Horseshoe (GGH), rejoining the ongoing price gains in housing markets located further east,” CREA says.

Cities in British Columbia and the Prairies were the only ones to post declines, with the Lower Mainland down 6.41%, Greater Vancouver down 7.28% and Fraser Valley down 4.68%. Calgary (-2.36%), Edmonton (-2.25%), Regina (-3.95%) and Saskatoon (-1.13%) were all also in a slump.

The difference between the two regions, however, is that prices in B.C. had more than doubled over the past five years prior to its downturn. The Prairies have seen a much more sustained downturn due to falling oil prices and a severe oversupply of housing.

The housing markets on the other side of the country have followed a very different trajectory. Nearly all markets in Ontario and the Maritimes rose significantly, both over the past year and also over the past five years. Greater Toronto, for example, is up 5.02% year-over-year and 57.02% over five years; Ottawa is up 9.61% year-over-year and up 28.58% from five years ago, and Greater Moncton is up 5.76% from last year and 23% from September 2014.

The difference in fortunes between East and West seems to be one of basic economics: the balance between supply and demand.

“The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers ample choice in these regions,” CREA noted. “By contrast, the measure is running well below long-term averages in Ontario, Quebec and the Maritime provinces, resulting in increased competition among buyers for listings and providing fertile ground for price gains.”

Sales simply continue to outpace new listings. National home sales rose 15.5% year-over-year, up from a six-year low reached in February 2018, but below the peaks reached in 2016 and 2017.

Meanwhile, sellers still appear hesitant to put their house on the market—new listings edged up less than 1%. The sales-to-new listings ratio, which measures competition, keeps rising and now stands at 61.3%, well above its long-term average of 53.6%.

That indicates the housing market is becoming increasingly tough for prospective buyers, who are competing with more buyers for fewer available properties. That can lead to price increases, bidding wars and pressure to leave out conditions in offers.

Until supply increases (or demand wanes), CREA expects long-term price gains in British Columbia, Ontario and the Maritimes.

For more information on September’s housing market, check out the infographic.

Dustan Woodhouse, President of Mortgage Architects, and a former active broker who has written multiple educational mortgage books, thinks so.

Dustan Woodhouse, President of Mortgage Architects, and a former active broker who has written multiple educational mortgage books, thinks so. “Big time…more than ever brokers are required,” Woodhouse said.

“Big time…more than ever brokers are required,” Woodhouse said.