BANK OF CANADA CUTS RATES 50 BPS TO 0.25%

Bank of Canada Moves to Restore “Financial Market Functionality”

The Bank of Canada today lowered its target for the overnight rate by 50 basis points to ¼ percent. This unscheduled rate decision brings the policy rate to its effective lower bound and is intended to provide support to the Canadian financial system and the economy during the COVID-19 pandemic (see chart below).

Strains in the commercial paper and government securities markets triggered today’s action to engage in quantitative easing. The Governing Council has been meeting every day during the pandemic crisis. Market illiquidity is a significant problem and one the Bank considers foundational. These large-scale purchases of financial assets are intended to improve the functioning of financial markets.

Credit risk spreads have widened sharply in recent days. People are moving to cash. Liquidity has dried up in all financial markets, even government-guaranteed markets such as Canadian Mortgage-Backed securities (CMBs) and GoC bills and bonds. The commercial paper market–used by businesses for short-term financing–has become nonfunctional. The Bank is making large-scale purchases of financial assets in illiquid markets to improve market functioning across the yield curve. They are not attempting to change the shape of the curve for now but might do so in the future.

These large-scale purchases will create the liquidity that the financial system is demanding so that financial intermediation can function. Risk has risen, which creates the need for more significant cash injections.

At the press conference today, Senior Deputy Governor Wilkins refrained from speculating what other measures the Bank might take in the future. When asked, “Where is the bottom?” She responded, “That depends on the resolution of the Covid-19 health issues.”

The Bank will discuss the economic outlook in its Monetary Policy Report at their regularly scheduled meeting on April 15. In response to questions, Governor Poloz said it is challenging to assess what the impact of the shutdown of the economy will be. A negative cycle of pessimism is clearly in place. The Bank’s rate cuts help to reduce monthly payments on floating rate debt. He is hoping to maintain consumer confidence and expectations of a return to normalcy.

The oil price cut alone would have been sufficient reason for the Bank of Canada to lower interest rates. The Covid-19 medical emergency and the shutdown dramatically exacerbates the situation. All that monetary policy can do is to cushion the blow and avoid structural problems to the economy. The overnight rate of 0.25% is consistent with market rates along the yield curve.

High household debt levels have historically been a concern. Monetary policy easing helps to bridge the gap until the health concerns are resolved. The housing market, according to Wilkins, is no longer a concern for excessive borrowing by cash-strapped households.

At this point, the Bank is not contemplating negative interest rates. Monetary policy has little further room to maneuver, given interest rates are already very low. With businesses closed, lower interest rates do not encourage consumers to go out and spend money.

Large-scale debt purchases by the Bank will continue for an extended period to provide liquidity. The Bank can do this in virtually unlimited quantities as needed. The policymakers are also focussing on the period after the crisis. They want the economy to have an excellent foundation for growth when the economy resumes its normal functioning.

Fiscal stimulus is crucial at this time. The newly introduced income support for people who are not covered by the Employment Insurance system is a particularly important safety net for the economy. There are many other elements of the fiscal stimulus, and the government stands ready to do more as needed.

The Canadian dollar has moved down on the Bank’s latest emergency action. The loonie has also been battered by the dramatic decline in oil prices. Canada is getting a double whammy from the pandemic and the oil price war between Saudi Arabia and Russia. The loonie’s decline feeds through to rising prices of imports. However, the pandemic has disrupted trade and imports have fallen.

The Bank of Canada suggested as well that they are meeting twice a week with the leadership of the Big-Six Banks. The cost of funds for the banks has risen sharply. CMHC is buying large volumes of mortgages from the banks, which, along with CMB purchases by the central bank, will shore up liquidity. The banks are well-capitalized and robust. The level of collaboration between the Bank of Canada and the Big Six is very high.

THE STOCK MARKET HAS HAD THREE GOOD DAYS

As the chart below shows, the Toronto Stock Exchange has retraced some of its losses in the past three days as the US and Canada have announced very aggressive fiscal stimulus. As well, the Bank of Canada has now lowered interest rates three times this month, with a cumulative easing of 1.5 percentage points. The Federal Reserve has also cut by 150 basis points over the same period. In addition to lowering borrowing costs, the central bank has also announced in recent days a slew of new liquidity measures to inject cash into the banking system and money markets and to ensure it can handle any market-wide stresses in the financial system.

The economic pain is just getting started in Canada with the spike in joblessness and the shutdown of all but essential services. Similarly, the US posted its highest level of initial unemployment insurance claims in history–3.83 million, which compares to a previous high of 685,000 during the financial crisis just over a decade ago. These are the earliest indicator of a virus-slammed economy, with much more to come. All of this is without precedent, but rest assured that policy leaders will continue to do whatever it takes to cushion the blow of the pandemic on consumers and businesses and to bridge a return to normalcy.

Coincidentally, on the same day of the BoC’s interest rate announcement, the Toronto Real Estate Board announced that the average home price in the Greater Toronto Area rose nearly 17% year-over-year in February to $910,290 (or $989,218 in the City of Toronto).

Coincidentally, on the same day of the BoC’s interest rate announcement, the Toronto Real Estate Board announced that the average home price in the Greater Toronto Area rose nearly 17% year-over-year in February to $910,290 (or $989,218 in the City of Toronto).

Economists at RBC Economics are among those anticipating a rate cut this week.

Economists at RBC Economics are among those anticipating a rate cut this week.

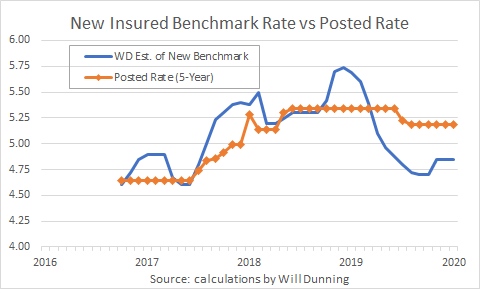

Critics say the big banks have been keeping their 5-year fixed posted rates artificially high since they are used in setting prepayment penalties. But with mortgage rates falling since last year, the mortgage stress test has been increasingly out of sync with the actual contract rates consumers are securing.

Critics say the big banks have been keeping their 5-year fixed posted rates artificially high since they are used in setting prepayment penalties. But with mortgage rates falling since last year, the mortgage stress test has been increasingly out of sync with the actual contract rates consumers are securing. While industry reaction has so far been favourable, some said there were likely ulterior motives for the sudden change in policy.

While industry reaction has so far been favourable, some said there were likely ulterior motives for the sudden change in policy.