Record Home Price Growth Continued in December

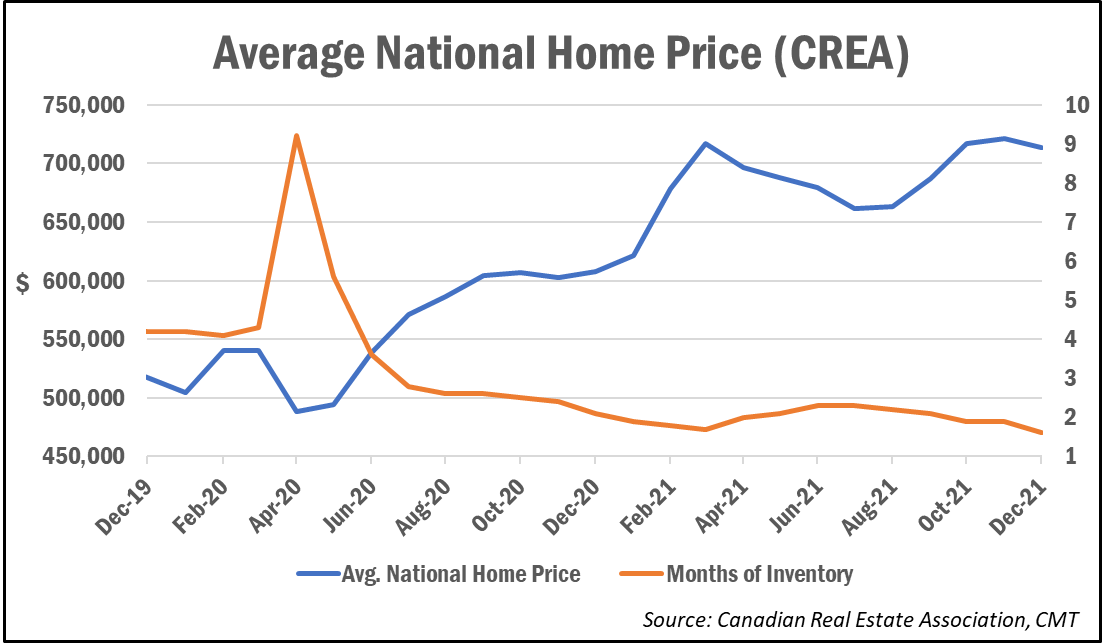

The Canadian Real Estate Association’s House Price Index was up 26% year-over-year as of December, the fastest pace on record.

Analysts say the ongoing price increases are being driven by falling inventory levels and increased demand as buyers try to make their purchases ahead of expected interest rate hikes from the Bank of Canada.

The number of months of inventory fell to a fresh record low of 1.6 months, well below the longer-term average of five months.

The average selling price in December was $713,500, up 17.7% year-over-year on an unadjusted basis, according to the CREA’s latest monthly report. Home sales ticked up in the month, rising 0.2% to 54,366. On an annual basis, home sales totalled 666,995, setting a new record and surpassing the previous high set in 2020 by more than 20%.

“With the housing supply issues facing the country having only gotten worse to start 2022, take any decline in sales early in the year with a grain of salt because the demand hasn’t gone away, there just won’t be much to buy until a little later in this spring,” said CREA chair Cliff Stevenson. “But when those listings eventually start to show up, the spring market this year will almost certainly be another headline grabber.”

Removing the high-priced markets of the Greater Toronto and Vancouver areas, the average price stands at $563,500.

Cross-Country Roundup of Home Prices

In just the past three months, average prices have risen by $125,600 in the Greater Toronto Area, $44,100 in the Greater Vancouver Area, $18,100 in Greater Montreal and $21,600 in Ottawa.

Here’s a look at some more regional and local housing market results for December:

- Ontario: $922,735 (+22.8%)

- Quebec: $473,032 (+17.9)

- B.C.: $1,031,067 (+22.5%)

- Alberta: $420,842 (+7.4%)

- Barrie & District: $836,200 (+38.8%)

- Greater Toronto Area: $1,208,000 (+31.1%)

- Victoria: $902,700 (+23.6%)

- Halifax-Dartmouth: $490,127 (+22.2%)

- Greater Montreal Area: $517,800 (+21.3%)

- Greater Vancouver Area: $1,230,200 (+17.3%)

- Ottawa: $661,500 (+16.1%)

- Winnipeg: $319,600 (+11.7%)

- Calgary: $451,200 (+9.7%)

- St. John’s: $292,000 (+9.3%)

- Edmonton: $336,600 (+4.1%)

Price pressures could persist throughout the year

As has been the case for several months already, future demand is being pulled forward as buyers try to make their purchases ahead of looming interest rate hikes.

“With interest-rate pull-forward behaviour keeping demand so strong, and supply struggling to keep up, it’s little wonder why prices are continuing their relentless upward march,” noted TD economist Rishi Sondhi. “However, while prices will likely increase this year, higher interest rates should slow the rate of increase. Notably, investor activity is climbing and these buyers are likely more sensitive to higher rates.”

Robert Kavcic, senior economist with BMO Economics, said interest rates have been left too low for too long, which has now resulted in the market becoming “unhinged.”

“Very early last year, BMO Economics warned that policy (starting on the monetary side) needed to tighten in order to prevent the market from becoming dislodged from underlying fundamentals…Now, it appears that 2021 was the year the market became unhinged,” he wrote. “Expectations and investor appetite took over Canadian housing in 2021. We know it, and policymakers now know it too. Look for 100 bps of tightening by the Bank of Canada this year to help clean out some of the froth.”

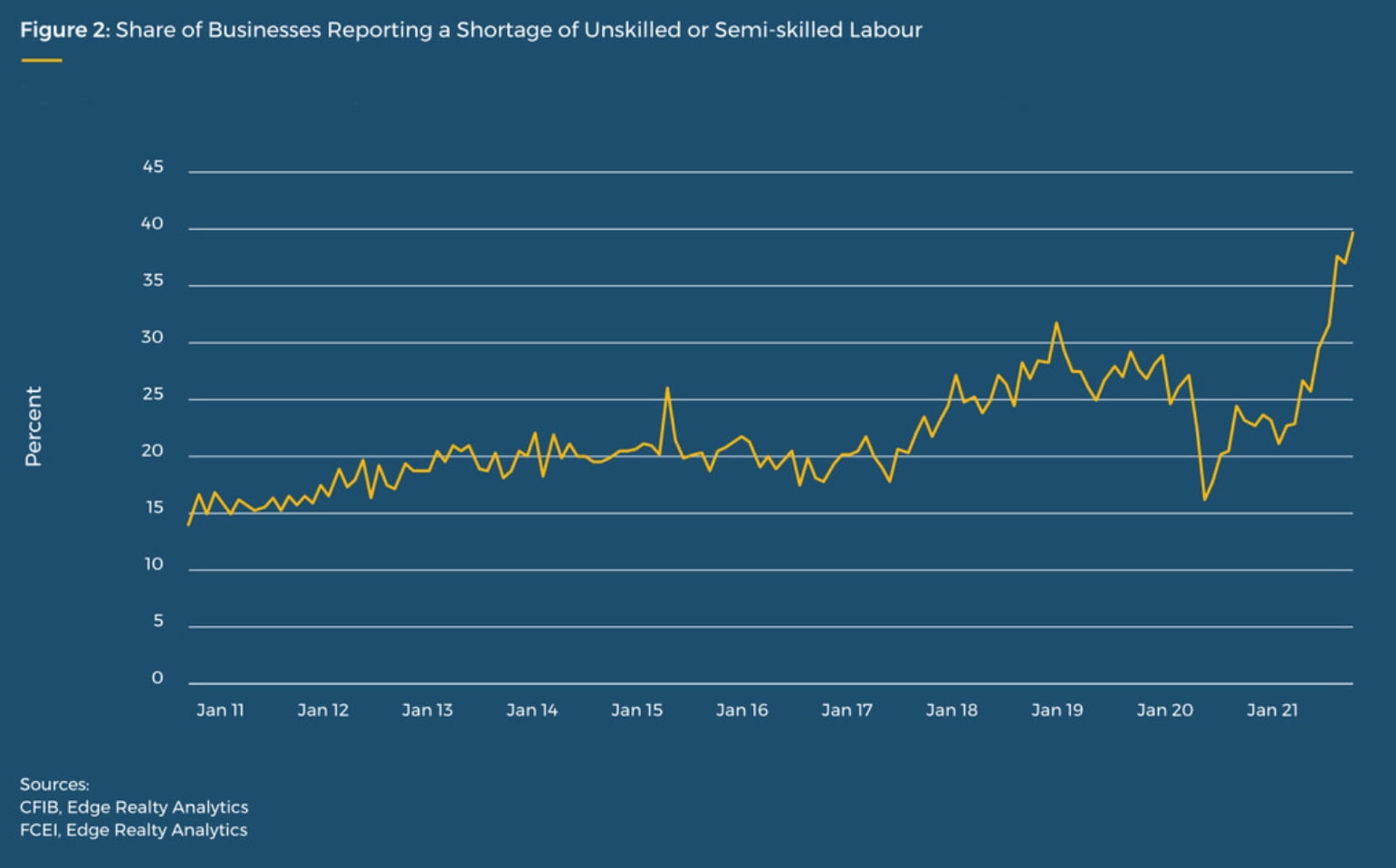

Even without the extra short-term demand, observers say a chronic shortage of housing supply will continue to keep upward pressure on prices until policymakers get serious about addressing the issue.

“There are currently fewer properties listed for sale in Canada than at any point on record. So, unfortunately, the housing affordability problem facing the country is likely to get worse before it gets better,” said CREA’s chief economist Shaun Cathcart.

“Policymakers are starting to say the right things, but now they have to act to change this course we’re on,” he continued. “An aggressive national push to build more homes is what will address the issue, but it will probably have to be a greater amount of building than anything we’ve ever undertaken. A touch over the status quo won’t cut it.”