JOBS STALL FOR SECOND MONTH IN A ROW, BUT WAGE GROWTH SURGES

The booming labour market in Canada seems to have vanished, at least for now, as employment declined and the unemployment rate rose again in July. Whether it is the summer doldrums, a trained worker shortage or the beginning of a slower second-half economy is yet to be seen. But the news is troubling in the wake of the accelerating trade tensions between China and the US. The US-Sino trade war has already sideswiped Canada, and President Xi Jinping does not face an election. He is not backing down, despite threats of a 10% additional tariff on all Chinese imports to the US. Trump’s response to denounce China as a currency manipulator has no teeth, raising doubts of the White House claim that trade wars are easy to win.

The booming labour market in Canada seems to have vanished, at least for now, as employment declined and the unemployment rate rose again in July. Whether it is the summer doldrums, a trained worker shortage or the beginning of a slower second-half economy is yet to be seen. But the news is troubling in the wake of the accelerating trade tensions between China and the US. The US-Sino trade war has already sideswiped Canada, and President Xi Jinping does not face an election. He is not backing down, despite threats of a 10% additional tariff on all Chinese imports to the US. Trump’s response to denounce China as a currency manipulator has no teeth, raising doubts of the White House claim that trade wars are easy to win.

Agriculture and manufacturing in Canada, China, the US and the rest of the world have already been hard hit. Businesses spending on capital equipment and software has slowed dramatically in the face of so much uncertainty. The global economy has slowed, and bond yields around the world have fallen sharply as money is moving to the safe havens of government bonds and gold. Yield curves in Europe and the US are now inverted, which is often a sign of coming recession.

In Canada this week, the 10-year government bond yield fell to 1.22% compared to 1.58% one month ago and 2.33% one year ago. The 5-year bond yield is also at 1.22%, down a whopping 14 basis points in one week. The best 5-year fixed mortgage rate has now dropped to roughly 2.30%, although borrowers still have to qualify at the Bank of Canada posted rate of 5.19%.

Consumer spending has held up, and housing activity is strengthening in Canada and the US. But if the economy slows and job markets weaken further, it is only a matter of time before households tighten their belts.

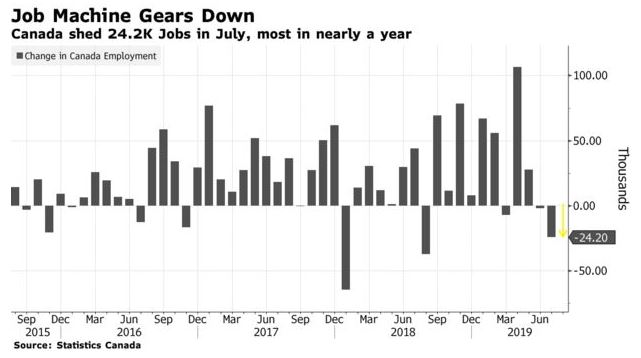

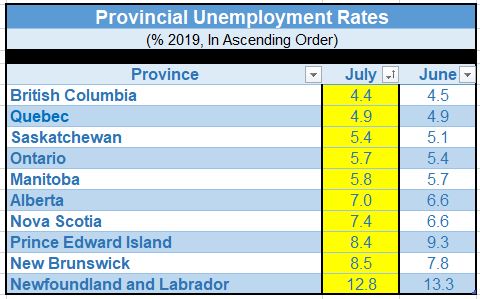

Canada’s labour market lost 24,200 jobs in July according to Statistics Canada, versus expectations for a gain of 15,000. That follows a decline of 2,200 jobs in June. The unemployment rate rose to 5.7%, a second monthly increase after reaching a 40-year low of 5.4% in May. Hours worked on a year-over-year basis slowed sharply, and the number of people employed by private sector companies plunged by the most since the last recession.

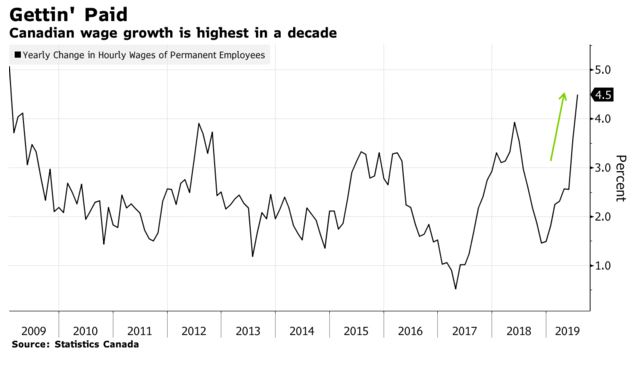

One of the few positive signs was accelerating wages, with hourly pay up 4.5% in July from a year ago (see chart below). That’s the most robust annual pay rise in a decade. Another area of strength was the construction sector, which recorded a 25,000 gain in employment.

Bottom Line: The disappointing jobs report and the broadening trade tensions will likely spur the notion that a Bank of Canada rate cut is coming. Accelerating wages might delay such a move. But if the global economy continues to slow, the Bank might add its name to the very long list of central bank rate cuts, which now includes the Fed. What has changed from my view just last week that the BoC would be on hold for the rest of the year is the widening trade war and the back-to-back slowdown in our jobs market.