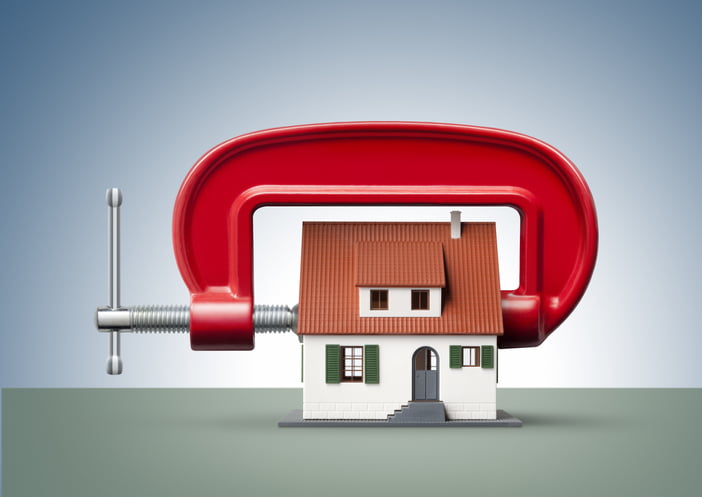

Stress Test Rate to Fall to 4.79%

The stress test rate is about to fall for the second time in three months following cuts by Canada’s Big Six banks to their 5-year fixed posted rates.

Mortgage experts say the Bank of Canada will reduce the benchmark qualifying rate—a.k.a., “stress test rate”—from 4.94% to 4.79% this week.

National Bank of Canada cut its posted 5-year fixed rate by 15 bps on Monday, following similar cuts by BMO and CIBC over the weekend, while RBC and TD lowered their rates last week.

In May, similar big-bank posted rate reductions caused the qualifying rate to fall from its then-current level of 5.04%, since the rate is based on a mode average of the big banks’ 5-year fixed posted rate. That marked their first time since January 2018, when OSFI’s stress test was introduced, that the benchmark qualifying rate fell below 5%.

“It will make qualifying easier, or permit some people to borrow fractionally more,” Paul Taylor, President and CEO of Mortgage Professionals Canada, told the Globe & Mail.

Just how much more? Well, not a whole lot in the scheme of today’s average home prices.

Rob McLister, founder of RateSpy.com, calculated that a buyer earning $70,000 a year and purchasing with the minimum 5% down would be able to afford roughly $4,000 more home, or about 1.2%.

“That’s not much to get excited about, but on a market-wide basis, small buying power improvements are inflationary for home prices, other things equal,” he wrote.

At 4.79%, the benchmark qualifying rate will be just 15 bps above the all-time low of 4.64%, last seen in July 2017, McLister notes.

Stress Test Still Well Above Market Rates

Despite the reduction, the stress test rate is still roughly 290 basis points above the lowest nationally available insured rate today.

“At present, [the current formula] results in a big increment above actual contracted interest rates,” noted MPC chief economist Will Dunning in a previous report.

And that’s despite the current interest rates expectations, including Bank of Canada Governor Tiff Macklem’s suggestion there will be no interest rate hikes for the next two or even three years.

“Interest rates are very low and they are going to be there for a long time,” Macklem said.

A Better Formula Still on Hold

While these recent small reductions to the mortgage qualifying rate are assisting affordability to a small degree, industry leaders have called on the federal government to proceed with a plan to change how the stress test rate is calculated.

While these recent small reductions to the mortgage qualifying rate are assisting affordability to a small degree, industry leaders have called on the federal government to proceed with a plan to change how the stress test rate is calculated.

In April, the Department of Finance said homebuyers purchasing with an insured mortgage would be stress-tested at a rate equal to the weekly median 5-year-fixed insured mortgage rate plus 2%.

At the time, when the stress test rate was 5.19%, the change would have reduced it to 4.89%. But in March, at the height of the COVID-19 pandemic, the government announced it would suspend the proposed changes.

A similar change for the uninsured mortgage stress test, which was being considered by the Office of the Superintendent of Financial Institutions (OSFI), was also put on hold.

The pause on new regulatory changes was sensible “given the marketplace uncertainty in March,” Taylor said last month. “However, as we begin to open businesses again…now is the time for OSFI and Finance to consider implementation of the new test.”