BoC Increasingly Likely to Deliver a Surprise Rate Cut This Week

Growing fallout from the coronavirus—including tanking stock markets and falling oil prices—means the Bank of Canada is increasingly likely to cut interest rates this week.

Just days ago, the market consensus was that the Bank of Canada would wait until its April meeting before lowering rates by 25 bps, in order to give the Governing Council more time to assess the situation.

But panic selling on the world’s stock markets, as well as a 25%+ drop in the price in WTI crude oil since the start of the year, means markets are nearly fully expecting the Bank of Canada to move its rate cut to its upcoming meeting this Wednesday.

Not only that, but markets are suddenly pricing in three quarter-point rate cuts by the end of the year.

Economists at RBC Economics are among those anticipating a rate cut this week.

Economists at RBC Economics are among those anticipating a rate cut this week.

“The plunge in global equity markets and sharp drop in commodity prices, in particular oil, are bumping up the risks that the confidence hit in financial markets will be mirrored in household and business sentiment,” said RBC’s Deputy Chief Economist, Dawn Desjardins. “The data doesn’t show this yet but with markets extrapolating what looked like a modest hit to global growth from the coronavirus into a full-fledged economic downturn, the bank is likely to want to lean against any deterioration in confidence.”

She added that the bank’s revised call for a rate cut does not remove the possibility for an additional rate cut in April.

“The Bank of Canada doesn’t want to further stoke this fire [household debt-to-income ratios reaching new highs] via rate cuts that could encourage home-buying behaviour,” added economists at TD Economics, who also expect a rate cut this week. “But the unfortunate truth is that it probably can’t do much to manage this market.”

Stephen Brown, Chief Economist at Capital Economics, added that increased confidence of price growth among homeowners may be welcomed by the BoC in this time of growing fear in equity markets.

“We think the Bank would only cut if it were convinced that the disruption caused by the virus elsewhere in the world has already been enough to seriously jeopardize domestic growth…The sharp downward moves in commodity prices are a bigger immediate risk, but volatile market moves may not be enough to persuade the Bank to cut either,” Brown wrote. “All that said, it clearly would not take much more to change the Bank’s mind. While it has been worried about the effects of looser policy on house prices, it may become more welcoming of a further boost to housing wealth if equity values continue to plummet.”

Derek Holt, head of capital markets at Scotiabank, urged the Bank to cut rates right away given the latest developments.

“The Bank of Canada needs to cut. Now. Enough dithering,” he wrote on Friday. “The greater risk to financial stability is not giving the economy a shot in the arm.”

Three Rate Cuts Suddenly Priced in for 2020

As quickly as coronavirus-induced fears have engulfed equity markets, so too have expectations changed for additional monetary policy easing this year.

Overnight Index Swap (OIS) markets as tracked by Bloomberg are now fully pricing in three 25-bps rate cuts by year’s end.

That would bring Canada’s overnight interest rate down to 1.00%, a level it hasn’t seen since December of 2017.

What This Means for Fixed and Variable Mortgage Rates?

Canadian 5-year bond yields have experienced a stunning collapse in recent weeks, falling from 1.66% as of January 1 of this year to a two-and-a-half-year low of 1.07% as of Friday.

Since bond yields lead fixed mortgage rates, we can expect mortgage lenders to continue lowering rates in the weeks ahead. As we reported last month, fixed rates have already been on the move lower, with the lowest nationally available insured 5-year fixed rate falling to 2.33%. Since then, they’ve already crept down to 2.32%, according to rate-tracking website RateSpy.com. That’s down from 3.19% a year ago.

Falling bond yields are good news for fixed-rate holders, who should expect rates to continue to trend lower in the weeks ahead if fears over coronavirus persist and economic data continues to soften.

As of Monday morning, HSBC announced new rate specials, including a high-ratio 3-year fixed rate of 1.99%.

But for the first time in a while, variable-rate mortgage holders may finally see some rate relief as well if the Bank of Canada follows through with its expected rate cuts.

Average variable rates currently stand at 2.82%, as tracked by RateSpy, compared to 2.59% for fixed-rate mortgages.

But rates may not fall completely in lock-step with BoC rate cuts, say some. Variable-rate mortgages are based instead on prime rate, which is set by the country’s big banks.

With the big banks’ revenue under pressure in this time of flat to inverted yield curves, rate expert Rob McLister of RateSpy.com says not to expect them to lower prime rate to the same extent that the BoC lowers the overnight rate.

“Given this, and rising loan loss provisions and higher risk premiums, I would not bet on banks passing along a full BoC cut to borrowers. That said, hopefully I’m wrong and we’re all pleasantly surprised,” he told CMT.

But that’s not a reason for borrowers to avoid variable rates, he adds.

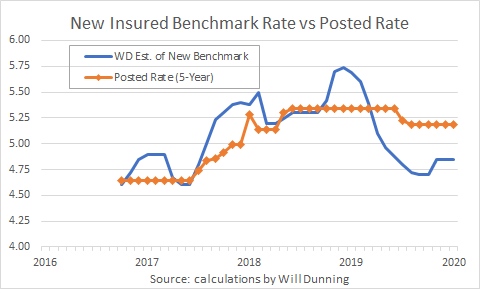

Critics say the big banks have been keeping their 5-year fixed posted rates artificially high since they are used in setting prepayment penalties. But with mortgage rates falling since last year, the mortgage stress test has been increasingly out of sync with the actual contract rates consumers are securing.

Critics say the big banks have been keeping their 5-year fixed posted rates artificially high since they are used in setting prepayment penalties. But with mortgage rates falling since last year, the mortgage stress test has been increasingly out of sync with the actual contract rates consumers are securing. While industry reaction has so far been favourable, some said there were likely ulterior motives for the sudden change in policy.

While industry reaction has so far been favourable, some said there were likely ulterior motives for the sudden change in policy.

–

–

Since the initiative was first

Since the initiative was first

That’s according to a recent

That’s according to a recent  HELOC Borrowing Falls for First Time in Four Years

HELOC Borrowing Falls for First Time in Four Years