These Homeowners Need a Private Mortgage

Most of us don’t give much thought to private mortgages. We are vaguely aware they exist, but perhaps have the impression they are mortgage solutions for financial derelicts.

But that is totally not true. More often than not, they are needed when bad things happen to good people.

And private mortgages and B-lender mortgages are the fastest-growing segment of the Canadian mortgage industry.

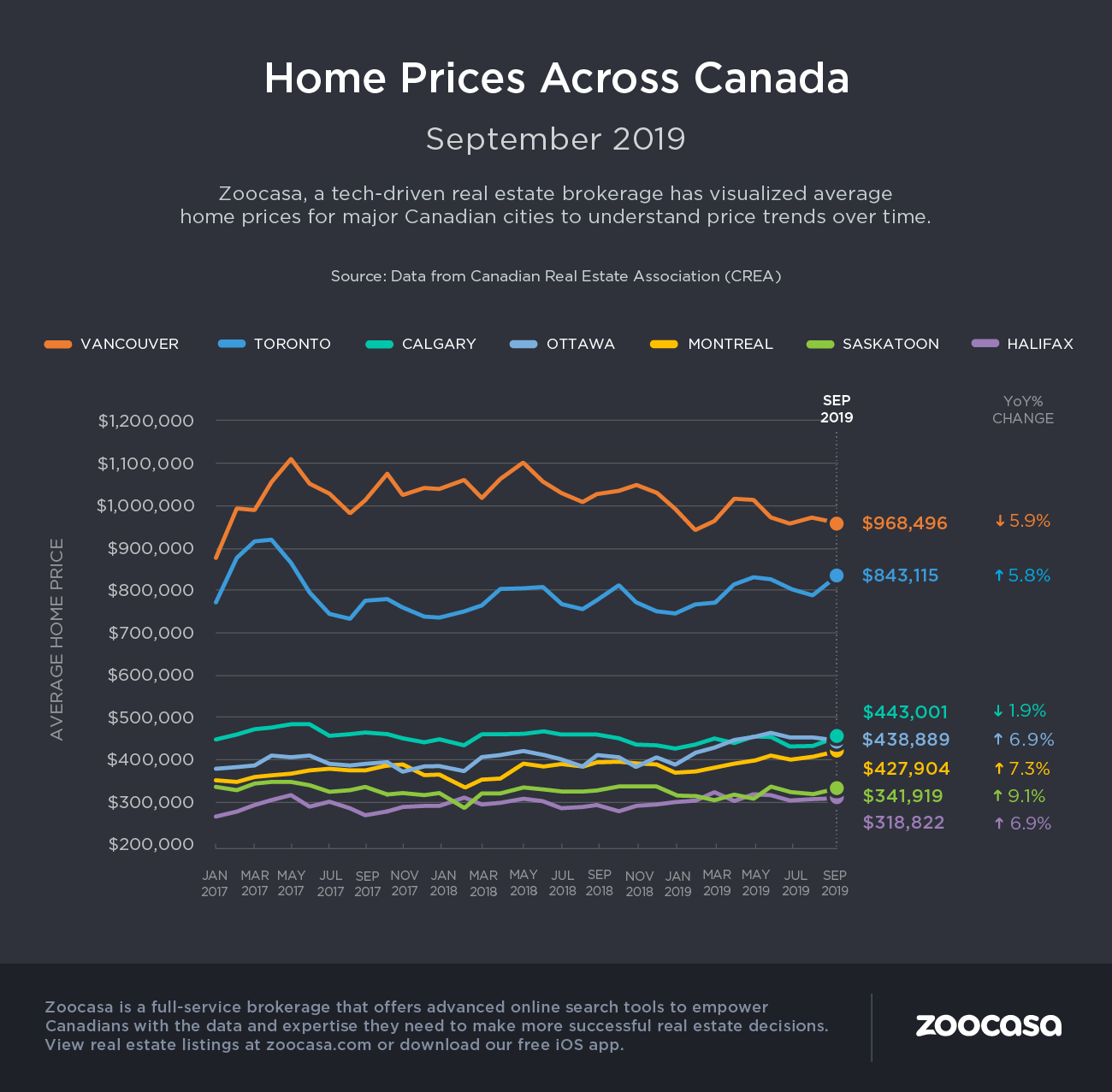

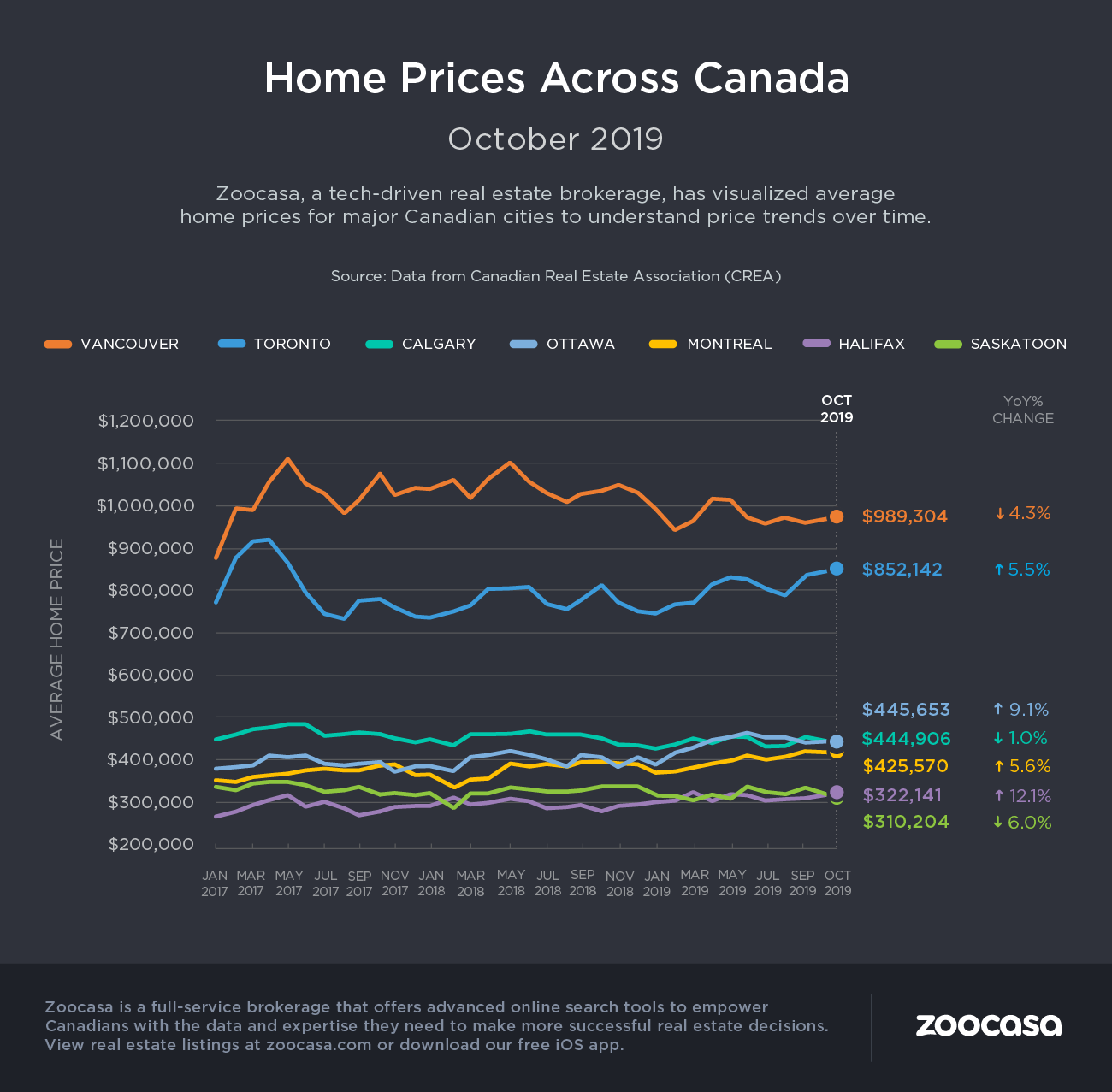

One reason is because it’s much harder to qualify for an A-lender mortgage now than at any time in recent memory. High home prices, in major cities particularly, result in large mortgage requirements, and the mortgage stress test can put qualification out of reach for homeowners who previously had no such concerns.

In addition, there are several situations people find themselves in which are not attractive to regular mortgage lenders. These problems require solutions, but a different type of lender needs to step forward and help the homeowner get on track. Let’s look at three such situations.

#1) This homeowner has too many debts, and his credit score is low. Notwithstanding lots of equity in his home, the banks have said no.

#2) These homeowners are in the middle of a consumer proposal. The doors to the banks are firmly closed, yet they need to finance a car purchase, and they would like to improve their monthly cashflow.

#3) This homeowner has large CRA debt. Banks and other A-lenders do not like refinancing to pay off CRA debt.

#1) Too Much Debt And Credit Score Too Low

This fellow has been living proud and mortgage-free for several years, but meanwhile has racked up credit card debt that just won’t go away. At first, people believe they can manage it down, but the crippling high interest rates of 19.99% or more make it really hard.

This fellow has been living proud and mortgage-free for several years, but meanwhile has racked up credit card debt that just won’t go away. At first, people believe they can manage it down, but the crippling high interest rates of 19.99% or more make it really hard.

And when the cycle starts, they next tap into other available credit to pay off the credit cards that are giving them a problem.

When he approached us, he had a nice town home in the west end of Toronto, $115,000 of unsecured debt, and a credit score of 557. And he had no mortgage.

The minimum monthly payment on the credit card debt was not much less than his take home pay from his job!

The Solution

We could see his credit score would zoom upwards once all the debts were cleared and no remaining balances. So, we found a private lender who was happy to lend a new first mortgage on very favourable terms. An annual mortgage interest rate of 5.99%, and a mortgage fully open after three months. This means as soon as he is ready, he can refinance to an A-lender without penalty.

And when that happens, all the ugly credit card debt will be scrunched up into a mortgage at roughly 3% interest, with a monthly payment of around $500. This is a game-changer compared to the $3,000 per month or so he was paying before.

#2) In A Consumer Proposal

These homeowners both have decent jobs and more than $200,000 equity in their detached B.C. home. Three years ago they both had to file a consumer proposal after a new business venture failed and left them with lots of consumer debt.

These homeowners both have decent jobs and more than $200,000 equity in their detached B.C. home. Three years ago they both had to file a consumer proposal after a new business venture failed and left them with lots of consumer debt.

They reached out to us for three reasons:

1) Their bank, which holds their first mortgage, has told them they will not offer a renewal in late 2020.

2) Their car lease is expiring in January 2020, and they want to exercise the buy-out option. They are being quoted crazy high interest rates on a car loan.

3) They are finding it tough, paying $1,300 each month towards the proposals, on top of their car payment, and also their mortgage, taxes and utilities.

The Solution

The solution here is a one-year, private second mortgage for around $60,000. Interest-only payments at a rate of 12%, and the monthly payment is only $600, which is half of what they are paying now on their consumer proposal.

This small new mortgage will pay off their proposal completely, and also allow them to buy the car when it comes off lease.

And after their proposal is paid off, we will coach them on rebuilding their personal credit histories. And we will send an investigation package to Equifax Canada requesting they clean up all the reporting errors. (Sadly, there are ALWAYS reporting errors in the credit report after filing a consumer proposal.)

And in late 2020, when their first mortgage matures, they won’t have to worry about the renewal. We will refinance both mortgages into one new mortgage with a different lender. They will be ready.

#3) CRA Debt Problem

Several months ago, we met a Mississauga homeowner who only owed $70,000 on his first mortgage, but he had neglected filing corporate taxes for a few years, and owed CRA significant money. There was a judgment against him for $49,000, which had been registered as a lien against the family home. And another one looming for $133,000. And he had also accumulated a large amount of unsecured debt.

Several months ago, we met a Mississauga homeowner who only owed $70,000 on his first mortgage, but he had neglected filing corporate taxes for a few years, and owed CRA significant money. There was a judgment against him for $49,000, which had been registered as a lien against the family home. And another one looming for $133,000. And he had also accumulated a large amount of unsecured debt.

If you are self-employed and owe a lot of money to CRA, your borrowing options are very slim in the world of conventional mortgage lenders. We talked about this in a previous article. Occasionally we encounter homeowners whose tax debt is so large it cannot be readily paid. The end result is a debt that can’t be negotiated away, with a creditor you can’t afford to ignore.

The Solution

The solution for our clients was either going to be a very large, disproportionate private second mortgage at a high interest rate (close to 12%) or to refinance the small first mortgage to a new private first mortgage at only 6.99%.

For a lengthier discussion about the costs associated with a private mortgage, you can read this article.

We took the first mortgage approach; paid off the CRA liens and all other personal debts. As a bonus, the lender allowed us to partially prepay the mortgage payments in advance, so that the monthly payment for the new mortgage would be roughly what it will be when they refinance down the road – avoiding payment shock!

Then we contacted Equifax Canada to confirm the tax liens had been cleared and waited for the client’s credit score to rocket upwards, unencumbered by a high debt load.

Sure enough, it all came to pass, and now we are refinancing the private mortgage into an A-lender, only six months later.

The Wrap

In our first two cases, we also gave consideration to B lender solutions. They were a legitimate option, but here the private mortgage made more “dollars and sense.”

In our first two cases, we also gave consideration to B lender solutions. They were a legitimate option, but here the private mortgage made more “dollars and sense.”

There are many other reasons why you might one day need a private mortgage. This article told the story of three fairly common situations.

You can find a more in-depth look at why you might need a private mortgage here. If a private mortgage is in your future, you should tread carefully and satisfy yourself you are dealing with reputable people who will treat you fairly.

–Ross Taylor

This fellow has been living proud and mortgage-free for several years, but meanwhile has racked up credit card debt that just won’t go away. At first, people believe they can manage it down, but the crippling high interest rates of 19.99% or more make it really hard.

This fellow has been living proud and mortgage-free for several years, but meanwhile has racked up credit card debt that just won’t go away. At first, people believe they can manage it down, but the crippling high interest rates of 19.99% or more make it really hard. These homeowners both have decent jobs and more than $200,000 equity in their detached B.C. home. Three years ago they both had to file a consumer proposal after a new business venture failed and left them with lots of consumer debt.

These homeowners both have decent jobs and more than $200,000 equity in their detached B.C. home. Three years ago they both had to file a consumer proposal after a new business venture failed and left them with lots of consumer debt. Several months ago, we met a Mississauga homeowner who only owed $70,000 on his first mortgage, but he had neglected filing corporate taxes for a few years, and owed CRA significant money. There was a judgment against him for $49,000, which had been registered as a lien against the family home. And another one looming for $133,000. And he had also accumulated a large amount of unsecured debt.

Several months ago, we met a Mississauga homeowner who only owed $70,000 on his first mortgage, but he had neglected filing corporate taxes for a few years, and owed CRA significant money. There was a judgment against him for $49,000, which had been registered as a lien against the family home. And another one looming for $133,000. And he had also accumulated a large amount of unsecured debt. In our first two cases, we also gave consideration to B lender solutions. They were a legitimate option, but here the private mortgage made more “dollars and sense.”

In our first two cases, we also gave consideration to B lender solutions. They were a legitimate option, but here the private mortgage made more “dollars and sense.”