BANK OF CANADA REDUCES PROSPECTS OF A RATE HIKE

A greater-than-expected slowdown in global economic activity has triggered a slowdown in the pace of interest rate normalization by many central banks. In response to these central bank policy changes and perceived progress in U.S.-China trade talks, global financial conditions and stock market sentiment have improved, pushing up oil and other commodity prices.

A greater-than-expected slowdown in global economic activity has triggered a slowdown in the pace of interest rate normalization by many central banks. In response to these central bank policy changes and perceived progress in U.S.-China trade talks, global financial conditions and stock market sentiment have improved, pushing up oil and other commodity prices.

Oil prices have risen since January in response to improved market sentiment, a greater-than-expected output cut in Saudi Arabia and risks of falling production in Iran, Venezuela and Libya. In its projection, the Bank assumes that the prices of Brent and WTI oil will remain close to their recent average levels. Uncertainty around the future path for global oil prices, however, remains elevated. The most important considerations relate to OPEC policy and geopolitical risks to production. As well, U.S. shale output could increase at a faster pace than expected.

In Canada, growth during the first half of 2019 is now expected to be slower than was anticipated in the January Monetary Policy Report (MPR). In another very dovish statement, the Bank of Canada acknowledged this morning that the slowdown in the Canadian economy has been more profound and more broadly based than it had expected earlier this year. The Bank had forecast weak exports and investment in the energy sector and a decline in consumer spending in the oil-producing provinces. However, as indicated by the mere 0.1% quarterly growth in GDP in the fourth quarter, the deceleration in activity was far more troubling. Investment and exports outside the energy sector have been negatively affected by trade policy uncertainty and the global slowdown. Weaker-than-anticipated housing and consumption also contributed to the downturn.

As was unanimously expected, the Bank maintained its target for the overnight rate at 1-3/4% for the fourth consecutive time. As well, the Bank dropped any reference to future rate hikes, bringing its policy in line with the Federal Reserve and other major industrial central banks.

“The Bank expects growth to pick up, starting in the second quarter of this year. Housing activity is expected to stabilize given continued population gains, the fading effects of past housing policy changes, and improved global financial conditions. Consumption will be underpinned by strong growth in employment income. Outside of the oil and gas sector, investment will be supported by high rates of capacity utilization and exports will expand with strengthening global demand. Meanwhile, the contribution to growth from government spending has been revised down in light of Ontario’s new budget.”

Overall, the Bank projects real GDP growth of 1.2% in 2019 and around 2% in 2020 and 2021. This forecast implies a modest widening of the output gap, which will be absorbed over the projection period. Inflation is close to the 2% central bank target.

The central bank clearly stated that given all of these economic conditions, an accommodative policy interest rate continues to be warranted. The policy statement added that the Governing Council “will continue to evaluate the appropriate degree of monetary policy accommodation as new data arrive. In particular, we are monitoring developments in household spending, oil markets, and global trade policy to gauge the extent to which the factors weighing on growth and the inflation outlook are dissipating”.

Bottom Line: The Bank of Canada has revised down its estimate of the neutral nominal policy rate. The neutral rate is defined as the sum of two components: i) the real rate that is consistent with output at its noninflationary potential level, and ii) 2% to account for the target inflation rate. The Bank now estimates the neutral rate to be about a quarter percentage point lower than assessed in April of last year, in a range of 2.25% to 3.25%. The midpoint of the range for potential output growth is now estimated to be slightly lower than in the April 2018 MPR, at 1.8% on average between 2019 and 2021 and at 1.9% in 2011. It is likely that these reassessments are consistent with unchanged policy interest rates for the remainder of this year.

Housing Market Details in the April Monetary Policy Report

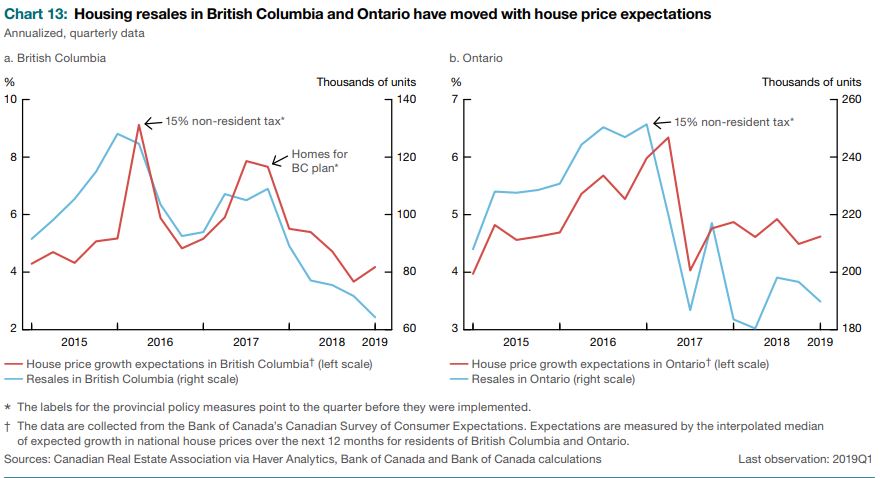

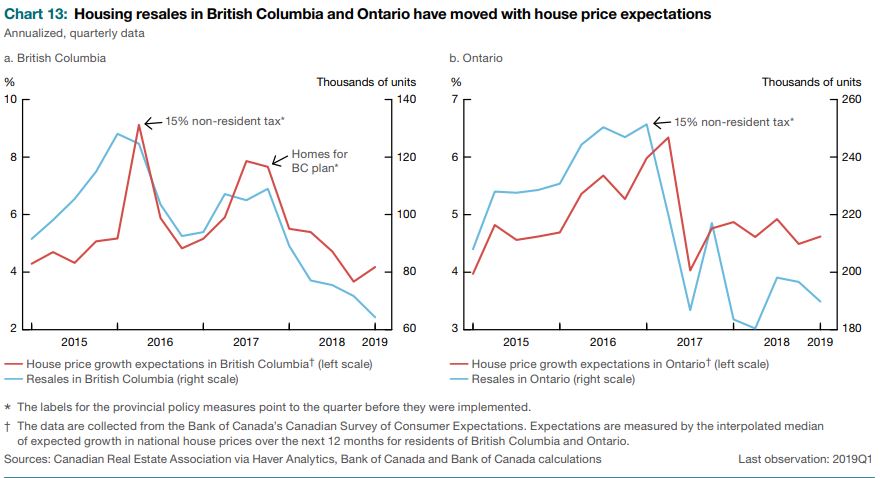

While housing is expected to stabilize at the national level, the Bank is aware of the risks to the outlook, particularly in the Greater Vancouver Area. For instance, the effects on growth of the revised B-20 guideline are expected to dissipate in many markets, although they could persist longer in areas with high house prices and that have been subject to other changes to housing policies. The stabilization of expectations for house prices in British Columbia and Ontario may indicate a forthcoming stabilization and subsequent increase in resale activity (see Chart 13 below).

The changes to local and provincial policies to address speculation, combined with the B-20 revisions, are having more pronounced effects in the Greater Vancouver Area (GVA) than in the Greater Toronto Area. Thus, while stabilization of activity is expected this year in the base-case projection, there is a risk that it could be delayed in the GVA.

Meanwhile, ongoing challenges in the oil industry are expected to continue to weigh on the Alberta housing market. In contrast, a strong economy and investor interest are expected to boost the market in Montréal.

The First-Time Home Buyer Incentive introduced in the 2019 federal budget is expected to support housing demand and may also lead to improving sentiment in the housing market. However, delays in purchases by homebuyers who want to take advantage of the new measure could influence the timing of resale activity in 2019.

After declining for two years, residential investment is expected to expand modestly in 2020 and 2021. Given the trend reduction in housing affordability, construction of multi-unit residences is expected to resume its trend increase to meet demand for less-expensive homes.

-Dr. Sherry Cooper

You know at one time I could give you a quote over the phone and not worry that I would be too far out. Today is a totally different story, here are some of the variables that come into play.

You know at one time I could give you a quote over the phone and not worry that I would be too far out. Today is a totally different story, here are some of the variables that come into play.