Real Estate’s Double-Edged Sword

It’s easy to forget the power of leverage.

With $100,000 of income, a creditworthy borrower can now qualify for almost three times the mortgage they did in the early 1980s.

Decades of falling interest rates and expanding credit availability have made that possible, while acting as a giant lever for home values and mortgage activity.

The prosperity that’s been created in our industry this millennium is truly phenomenal, and it’s largely thanks to an unprecedented vertical climb in real estate.

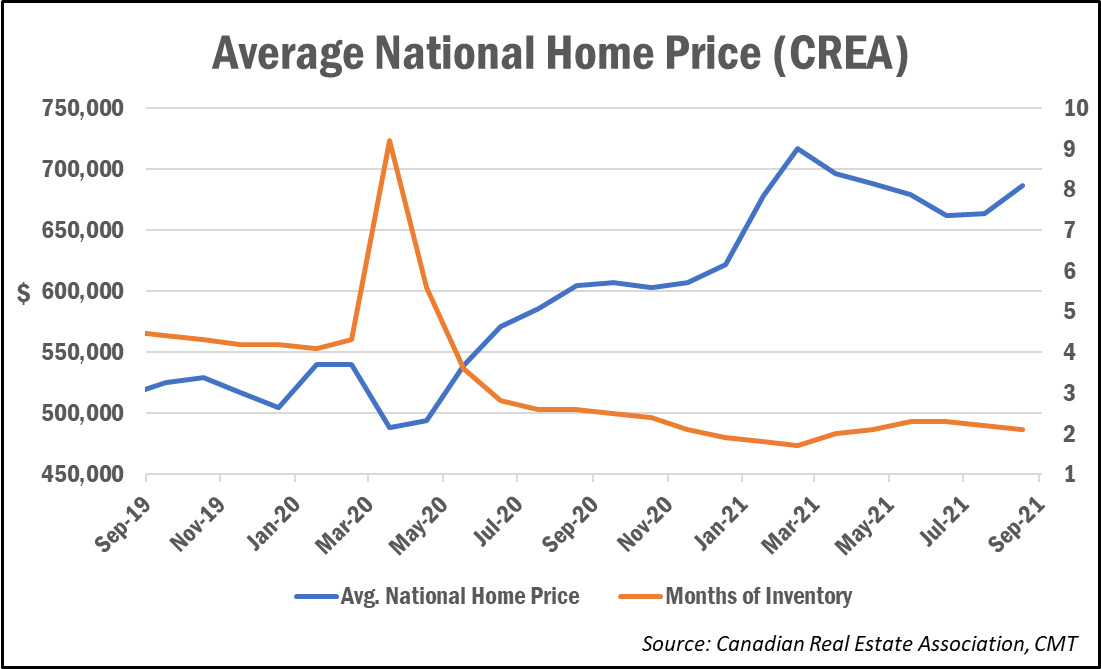

Perhaps no chart illustrates the result of real estate leverage, imbalanced housing supply and rising incomes better than this one.

Source: Karl Schamotta, Chief Market Strategist, Cambridge Global Payments (adapted from a Federal Reserve Bank of Dallas dataset developed by Mack and Martínez-García)

Fifteen years ago, housing bears started warning that home prices were deviating from fundamentals. This graph shows what happened next.

Needless to say, the market had its own ideas about which “fundamentals” mattered.

And of course, housing bears said the very same thing ten years ago. Five years later they echoed the same warning. Today, they’re saying it again. But this time, they’re arguably getting closer to being right.

Catalysts change

Contrary to bearish disinformation, real estate values don’t rise on air. Prices—and our businesses as mortgage brokers—would never be at today’s heights if it weren’t for fundamental forces (falling rates, rising incomes, population growth, urbanization, supply shortages, etc.). Speculative mindsets aside, people pay ever more for properties because actual fundamentals give them reason too.

But fundamentals are a funny thing. They change.

When prices get so unattainable that Canadians making above-average incomes can’t afford even average homes, supply adjusts. It has to.

Of course, so far it hasn’t, at least not to any game-changing degree. But, given enough time and extremes prices, supply always adapts. That’s been true all throughout history, even if only for a short time—whether driven by developers in search of excess profits, by governmental policy or by shifting trends (like work-from-home or high-speed commuting, which makes building on cheaper land economically viable).

What’s at stake?

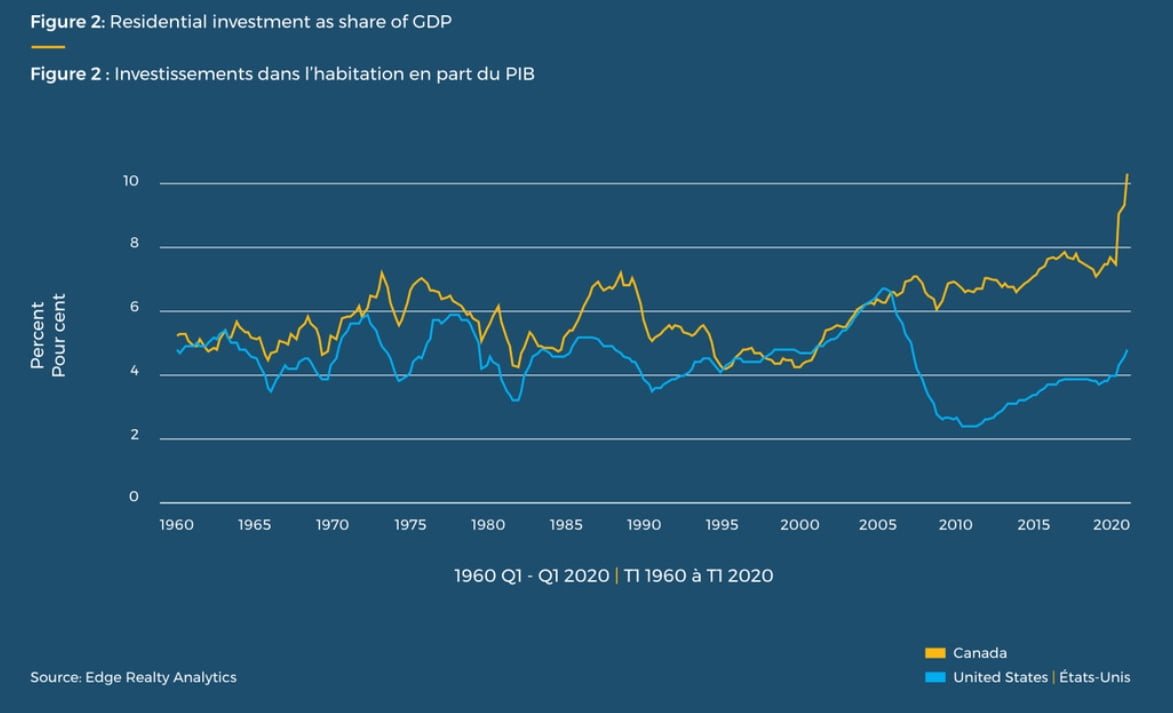

Canada’s economy relies twice as much on residential investment to fuel GDP, versus 20 years ago. For the first time ever, residential investment like new construction, renovation services, mortgage brokering and real estate services total over 10% of GDP.

In all, residential investment accounted for a remarkable 54% of GDP gains in the first quarter, according to Edge Realty Analytics.

Canada’s economy literally cannot afford its housing train going off the rails.

Watch those rates

That brings us back to our original premise: Leverage is a powerful thing. That is, until you run out of it.

The two-way sword of leverage cuts in the wrong direction when interest rates climb. And if one believes implied pricing in the bond market, rates are headed roughly 175 basis points higher in the next 24 months.

Take away rock-bottom rates after a parabolic price increase—let alone after other credit tightening (e.g., tougher qualifying rates or limits on amortizations, debt service ratios or non-prime lending)—and watch the magic of leverage work in reverse.

I’m not brazen enough to predict when the housing tide turns, but it will ultimately turn, for three reasons:

- In expansionary cycles, inflation always exceeds the Bank of Canada’s 2% target long enough to warrant rate hikes.

- The market will hit a point—if it hasn’t already—where average incomes are simply insufficient to qualify for financing on average homes.

- Supply will catch up, be it from new listings by nervous sellers hoping to lock in windfall capital gains, government initiatives, or just good old developer greed (the productive greed that incentivizes development).

When all this happens, that’s when housing bulls, industry professionals and homeowners (those who perish the thought of losing their accumulated home equity) will witness the inevitable, a new real estate cycle…one where leverage works in reverse.