Home Prices Post Monthly Gain as Supply Tightens

National home prices posted their first monthly increase since February as housing inventory tightened further to “extremely low” levels, the Canadian Real Estate Association reported.

The average selling price in August was $663,500, up 13.3% year-over-year and a 0.5% increase from July, ending a four-month streak of monthly price declines.

Since the March peak, average prices have fallen 7.4%. Removing the high-priced markets of the Greater Toronto and Vancouver areas, the average price stands at $533,500.

There were 50,876 home sales in August, down 14% from a year earlier, but still the second-best August result in history, CREA noted.

“Canadian housing markets appear to be stabilizing somewhere in between pre- and peak-pandemic levels—which is to say, still extremely unbalanced,” said Shaun Cathcart, CREA’s Senior Economist.

Housing Inventory Remains “Extremely Low”

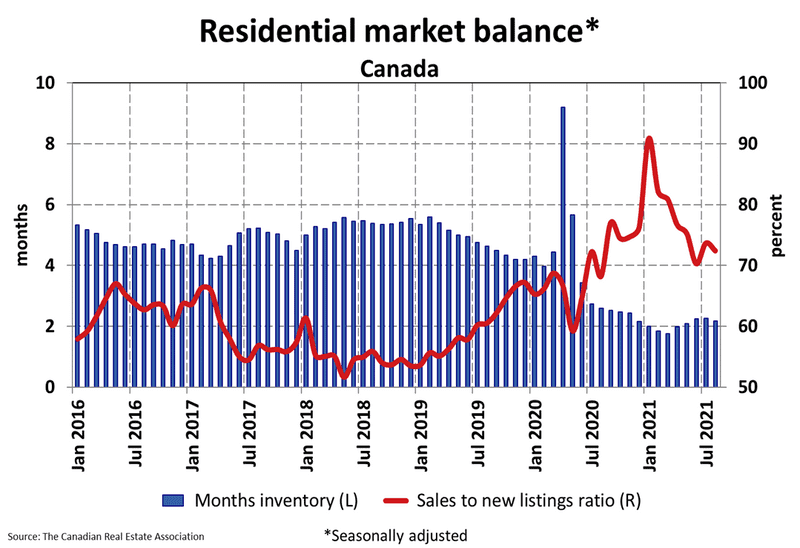

Already near a historical low, housing inventory ticked down to 2.2 months in August. Housing inventory is the amount of time it would take to liquidate current inventories at today’s rate of sales.

“This is extremely low–still indicative of a strong seller’s market at the national level and in most local markets,” CREA noted. “The long-term average for this measure is more than twice where it stands today.”

For housing analyst Ben Rabidoux, President of North Cove Advisors, the dramatic fall in supply is the big story in Canadian housing market.

“We’ve gotten inventory levels that are down 60% nationally from 2015 levels,” he said during a recent webinar hosted by Mortgage Professionals Canada. “Just an absurd relentless decline, and that is the story of Canadian housing right now.”

Rabidoux noted that inventory levels would need to more than double or home sales would have to fall in half—or some combination of both—before we see prices start to fall.

“We are so far from a balanced housing market that we can double supply and still be in a seller’s market,” he said. “So, we have a chronic shortage of supply.”

Cross-Country Roundup of Home Prices

Here’s a look at some more regional and local housing market results for August:

- Ontario: $834,932 (+15.1%)

- Quebec: $451,904 (+14.7%)

- B.C.: $899,173 (+16.8%)

- Alberta: $417,321 (+4.2%)

- Barrie & District: $739,200 (+35%)

- Greater Montreal Area: $497,800 (+21.7%)

- Victoria: $854,300 (+19.8%)

- Halifax-Dartmouth: $442,284 (+19%)

- Ottawa: $653,200 (+18.5%)

- Greater Toronto Area: $1,059,200 (+17.4%)

- Greater Vancouver Area: $1,176,600 (+13.2%)

- Winnipeg: $318,900 (+11.6%)

- Calgary: $446,500 (+10%)

- St. John’s: $286,200 (+7.6%)

- Edmonton: $343,100 (+5.8%)

CREA Lowers its Home Sales Forecast, Raises Price Expectations

Due to the tight supply conditions and rising home prices, the Canadian Real Estate Association unveiled an updated forecast for the year.

It now expects 656,300 homes to exchange hands in 2021, a jump of roughly 19% from 2020, but down slightly from its previous forecast of 682,900.

Looking ahead to 2022, home sales are expected to fall 12.1% to 577,000 units.

“Limited supply and higher prices are expected to tap the brakes on activity in 2022 compared to 2021, although increased churn in resale markets resulting from the COVID-related shake-up to so many people’s lives may continue to boost activity above what was normal before COVID-19,” CREA noted.

The association also bumped up its home price forecast for 2021 to $680,000, a 19.9% increase from 2020. It had previously forecast an average selling price of $678,000 for 2021.

Prices are expected to continue to rise in 2022 to an average of $718,000, up 5.6% on an annual basis.