Housing Market Recovery Continued in October

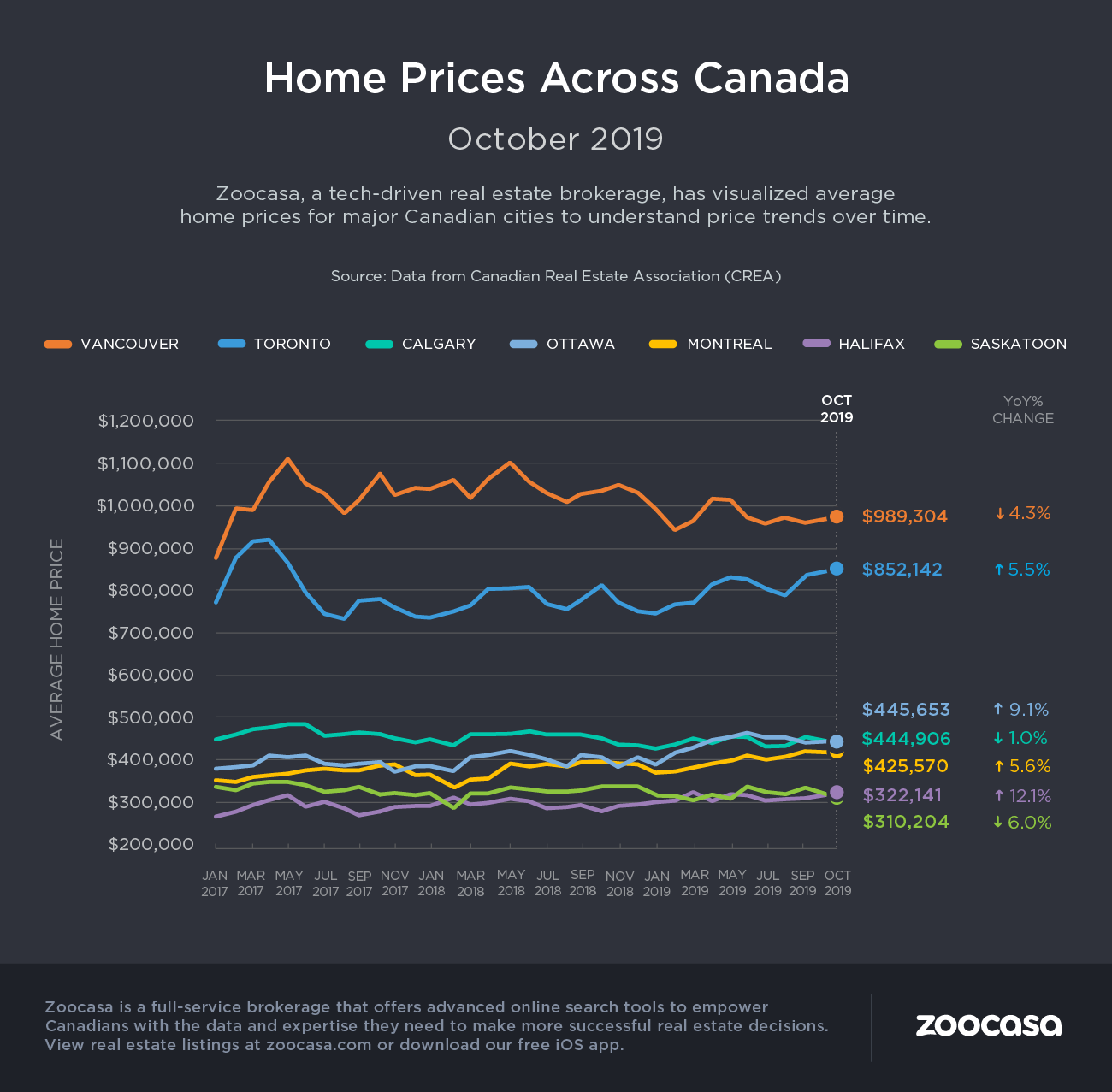

The national housing market continued its recovery in October, according to the Canadian Real Estate Association’s (CREA) recently released report.

While sales remain 7% below levels reached during 2016 and 2017, they are 20% above the six-year low reached in February. Transactions are up 12.9% year-over-year and higher in the vast majority of cities.

The benchmark price is up 1.8% year-over-year to $633,600 in the 19 markets CREA tracks.

Yet, CREA continues to blame tighter lending rules for softer-than-peak market conditions.

“Steady national activity in October hides how the mortgage stress test remains a drag on many local housing markets where the balance between supply and demand favours homebuyers in purchase negotiations,” said Jason Stephen, president of CREA. “That said, all real estate is local, so market balance varies depending on location, housing type and price segment.”

Borrowers must now qualify for a mortgage at least 2% higher than their contract rate, which is pushing them into less expensive housing types, or out of the market altogether. The move by the federal bank regulator is designed to protect the economy at large. Should interest rates rise, homeowners may be so strapped to pay their larger monthly mortgage payment that they will stop spending on other goods and services, and thus drag the economy at large into a recession.

Since Canadian household debt levels are currently higher than the national GDP, at about $1.6 trillion, and almost entirely due to mortgages, this is a very real fear. Borrowers can still get around the stress test by seeking out mortgages from credit unions or private lenders.

British Columbia, however, is likely experiencing a slump because of the new mortgage rules, plus a small tax on foreign buyers. Greater Vancouver prices are down 6.44% year-over-year, the Lower Mainland down 5.68% and Fraser Valley down 4.16%. The decline in benchmark prices is likely short-term.

Meanwhile, the Prairies have endured several years of declining prices and CREA says the region is on the cusp of a “full-blown buyer’s market.” They overbuilt during oil boom times and sellers are suffering the consequences. Regina’s benchmark price is down 7.12% year-over-year, Saskatoon is down 1.54% and Calgary prices are down 2.37%.

Ontario continues to do well, especially in the smaller cities in the southwest. Guelph’s benchmark price is up 6.45% year-over-year, Hamilton is up 7.11% and Toronto is 5.55% higher.

Prices are likely to continue to rise into 2020 because supply is tightening across the country. There were only 4.4 months of inventory at the end of October 2019—the lowest level recorded since April 2017. Furthermore, the national sales-to-new listings ratio is now at 63.7%, far above its long-term average of 53.6%.

“Based on a comparison of the sales-to-new listings ratio with the long-term average, just over two-thirds of all local markets were in balanced market territory in October 2019, including the GTA and Lower Mainland of British Columbia,” CREA reports. “Nonetheless, sales negotiations remain tilted in favour of buyers in housing markets located in Alberta, Saskatchewan and Newfoundland & Labrador.”

For more information on the national housing market this October, check out the infographic below: