National Home Prices Rose in September as Supply Tightened

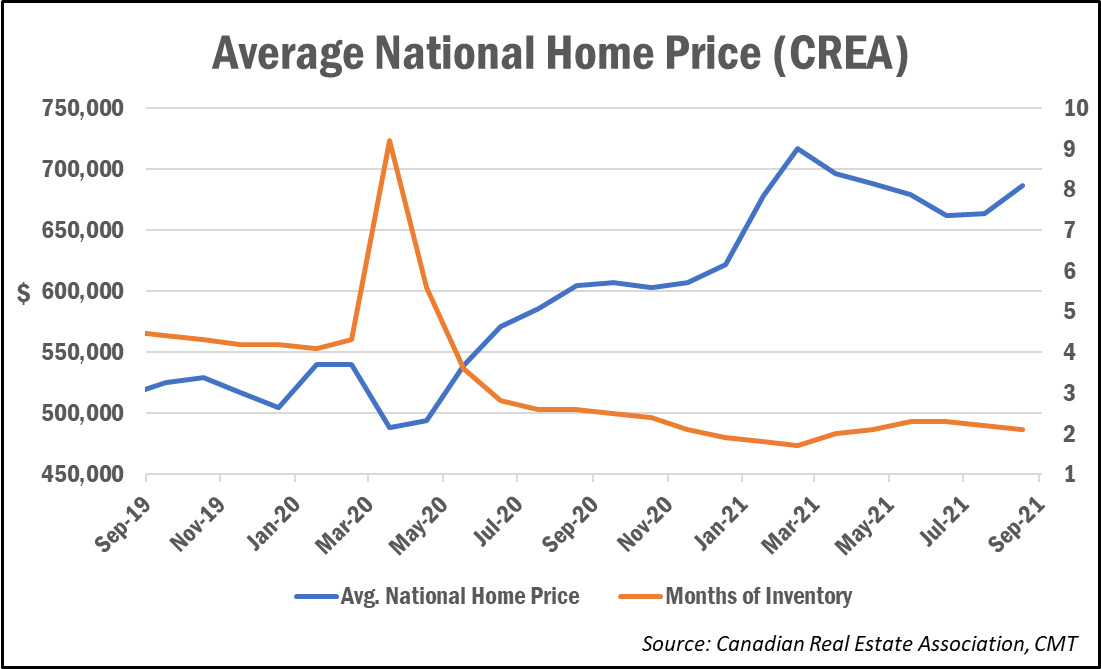

The national average home price re-accelerated in September, returning to a level last seen in May, while housing supply continued to trend down.

The average selling price in September was $686,650, up 13.9% year-over-year and 3.5% from July’s reading of $663,500.

Removing the high-priced markets of the Greater Toronto and Vancouver areas, the average price stands at $540,650.

There were 48,949 home sales in September, down 17.5% from a year earlier, but up 0.9% on a monthly basis, marking the first month-over-month increase since March, CREA noted.

Meanwhile, the tight supply conditions being seen across the country drove down the months of inventory measure to 2.1, well below the long-term average of roughly five months. New listings were also down 1.6% from July and 19.6% year-over-year.

Smaller changes in the monthly metrics suggest the market has now passed the period of extreme volatility seen since last spring, which was caused by the pandemic and related lockdowns, noted Shaun Cathcart, CREA’s senior economist.

“Having said that, given we are still stuck at around two months of inventory nationally, the thing to keep a close eye on going forward will be the behaviour of prices,” he said. “While the acceleration in home prices we saw in September was more than most would have expected, the fact that prices are now moving back in that direction is not surprising.”

Cross-Country Roundup of Home Prices

Here’s a look at some more regional and local housing market results for August:

- Ontario: $887,290 (+19.7%)

- Quebec: $458,955 (+15.4%)

- B.C.: $912,047 (+13.8%)

- Alberta: $415,821 (+3.5%)

- Barrie & District: $756,800 (+34.3%)

- Halifax-Dartmouth: $471,746 (+22.9%)

- Victoria: $861,900 (+21%)

- Greater Montreal Area: $499,700 (+20.8%)

- Greater Toronto Area: $1,082,400 (+19.1%)

- Ottawa: $639,900 (+16.3%)

- Greater Vancouver Area: $1,186,100 (+13.8%)

- Winnipeg: $318,400 (+11.5%)

- St. John’s: $291,100 (+9.6%)

- Calgary: $443,700 (+9.2%)

- Edmonton: $341,000 (+5.1%)

Looking Forward

All signs are pointing to more normalized readings in the months ahead, following what has been a turbulent and volatile 18 months for the housing market. This goes for both home sales and prices.

“The correction in sales from the unsustainable levels achieved earlier in the year is likely over, and September should mark the beginning of a modest positive trend in sales activity,” noted Rishi Sondhi, economist at TD Economics. “The key word here is modest, as interest rates are likely to grind higher moving forward, playing off against improving job markets, a rising population, and the decision by some households to plow excess savings into down payments.”

Sondhi added that federal housing policies could also provide some lift, but only to a small degree.

And where are home prices likely to go from here? Most signs are pointing up, say economists.

“The market has remained tight in seven of the 10 provinces (all favourable to sellers) and more balanced in Alberta and Saskatchewan,” wrote economists at National Bank of Canada. “These market conditions should continue to support price increases in the coming months.”

Interest rates are also expected to play a greater role in regulating demand as we head closer to the start of the next rate-hike cycle.

“One can’t help but feel as though the Canadian housing market is walking on tinder again, with demand holding at historically high levels, listings getting quickly absorbed, and price growth running steady near a 20% pace,” wrote Robert Kavcic, senior economist at BMO Economics.

“That said, 5-year fixed mortgage rates likely face meaningful upside in the months ahead, which could act as a dampener,” he added. “If not, or if there is a heavy rotation to variable [rates] and the market starts to accelerate again from here, talk of earlier Bank of Canada moves will only grow louder.”